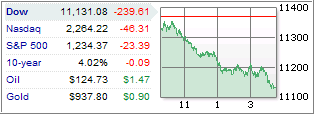

To me, yesterday’s market activity, as reflected by the chart from MarketWatch, resembled a black diamond ski slope, which I always tried to avoid during my skiing years just as I now try to stay away by not being an active participant on the long side when the bears rule.

To me, yesterday’s market activity, as reflected by the chart from MarketWatch, resembled a black diamond ski slope, which I always tried to avoid during my skiing years just as I now try to stay away by not being an active participant on the long side when the bears rule.

The major indexes had to endure a double punch caused by weak financial stocks and higher oil prices, nothing new there as the rally from two weeks ago seems to have been long forgotten. Additionally, Merrill Lynch’s need for more capital turned out to be a big drag on the S&P.;

The recent bounce back appears to have been just that, and not a major tend reversal, as our Trend Tracking Indexes (TTIs) seem to confirm. Here’s where we stand as of yesterday:

Domestic TTI: -3.82%

International TTI: -10.51%

We continue to be in a news-driven market with all eyes now focused on the big two reports, namely GDP and unemployment, both of which will be out Thursday and Friday.

This is the time to sit tight and watch the bears continue to battle for supremacy.