Based on recent emails, I know that many readers are scouring the investment globe for high yielding mutual funds/ETFs hoping to find a way to generate income or an above average rate of return.

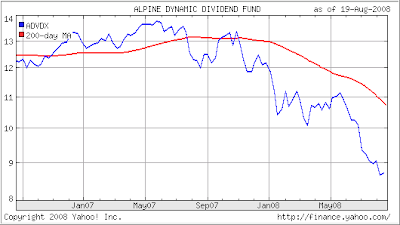

One of the highest yielding funds I have found is ADVDX, which sports a mouth watering annual yield of 18.11%, according to Yahoo.com. Let’s take a look at a 2-year chart:

All of a sudden this fund does not look so good, doesn’t it? Yahoo reports that during first 7 months of 2008, ADVDX has lost 18.61%. And that is the problem with income investing in general when the markets are engaged in a down trend, which is exactly what happened lat year. While income investors were able to generate a nice yield, they ended up losing twice that amount on the principal side. It’s simply robbing Peter to pay Paul, or worse.

While I have invested in ADVDX in the past, I have only done so during a clearly defined bull market and not when the bear was licking his chops. Investing for income in this environment requires the same rules of following trends i.e. be in when the trend is up and out when the trend reverses.

Otherwise, you may find yourself with a nice income on one side but with an overall deteriorating financial position on the other.