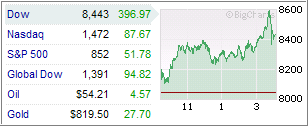

The markets continued their rebound yesterday, which started on Friday, and pushed the major indexes up over 10% in two trading days.

The markets continued their rebound yesterday, which started on Friday, and pushed the major indexes up over 10% in two trading days.

Supporting cast was the rescue of Citigroup by the US Government along with optimism that President elect Obama’s assembled team will be qualified for the job.

The big unknown was how much of that rally was simply short covering to lock in profits from the recent decline. Over the past few months, we have seen this type of sharp rebound from a new low several times.

Trying to avoid this type of whip-saw activity is the reason why I have stayed away from using any inverse mutual funds/ETFs. The volatility is still too high and any short positions would have triggered their sell stop points just as any long positions would not have gone anywhere.

I will continue to stay neutral until some kind of trend can be identified.