The ETF/No Load Fund Tracker—Monthly Review—July 31, 2012

The ETF/No Load Fund Tracker—Monthly Review—July 31, 2012

Super Mario’s Pledge Pulls Stocks Out Of The Doldrums

The European Central Bank President Mario Draghi’s pledge to do “whatever it takes” on July 26 to restore investor confidence in the euro zone triggered a global market rally.

Speculation was rife the ECB will initiate another round of LTRO, restart the Securities Market Program to buy Spanish and Italian bonds from the secondary market and cut the key interest rate further to boost growth.

The initial euphoria over Draghi’s bullish pledge, however, proved fleeting in the absence of clarity from the central bank, and markets remained cautious on the last two trading days of the month.

Nonetheless, all of the three major indexes finished higher in July with the Dow posting its ninth monthly gain in 10. The S&P 500 finished 1.3 percent higher over June while the NASDAQ ended near flat with a paltry 0.4 percent gain.

An important development in July was the downgrading of Germany to ‘AAA-negative’ from ‘Stable’ along with Netherlands and Luxemburg by Moody’s citing growing risk from a possible Greece exit or bailout for Spain and Italy.

US economic recovery remained steady though the pace fluctuated slightly. Data released on July 27 showed that GDP for the second quarter grew at a meager 1.5 percent against an estimated 1.2 percent. The economy had grown at 1.9 percent in the first quarter.

US Consumer Confidence rose for the first time in six months as Americans grew more hopeful of employment prospects. A separate report from the Commerce Department showed US wages climbed in June while consumer purchases slowed, indicating consumers are still pretty cautious about spending.

Economists expect growth to accelerate modestly in the third quarter due to continued recovery in the housing sector. The closely watched S&P/Case-Shiller 20-city composite index of US home values showed home prices rose 2.2 percent in May with all the 20 cities recording monthly gains. The Fed’s Beige Book also supported the recovery stating the residential housing indicators were largely positive though drought is a worry for crops and livestock.

The Q2 earnings season remained ho-hum with roughly two thirds of the 300 companies that announced results till July 27 managing to beat sharply reduced earnings forecasts. However, nearly 60 percent of the firms missed revenue forecasts, more than twice of that in Q1.

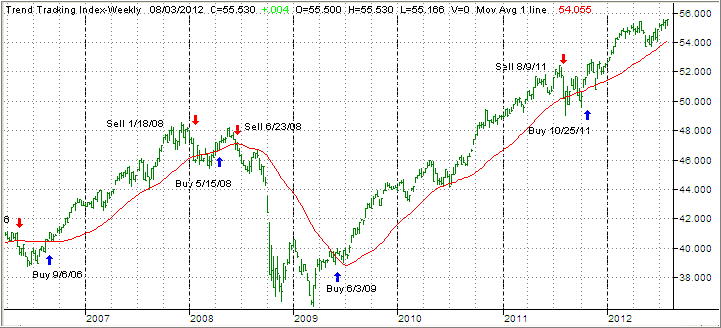

In terms of trends not much changed as the Domestic Trend Tracking Index (TTI) remains on bullish side of the trend line by +2.72% as the chart shows:

While we have distanced ourselves a bit from a possible trend line break, as opposed to where we were last month, we also have reached extremely lofty market levels not due to sound underlying economic fundamentals, but only due to the ever present Fed and its financial weaponry ready to be deployed to prop up the markets.

As we’ve seen this past week, just empty jawboning without substance by the likes of ECB head Draghi proved sufficient to move the markets higher—at least for the moment!

There were no changes to our invested positions, and I continue to observe market behavior with a very skeptical eye, especially when it comes to Europe. Since there is no sound policy in place to reduce debt and deal with insolvency, all plans are simply calling for more debt to postpone the inevitable. If can kicking were to be an Olympic sport, the Europeans would very likely take gold, silver and bronze.

Once the first domino falls (default), which to me is not a question of ‘if’ but ‘when,’ there will be consequences to markets around the world and those who believe the US can decouple are just not thinking clearly. I plan on being prepared for when that happens via our exit strategy; although the timing of such an event remains the big unknown.

Contact Ulli