Reader MD was interested in mutual funds that automatically protect any profits made. He had this to say:

I am interested in No Load mutual funds, which use hedging strategies like shorting or buying options to protect the gains realized.

Don’t I wish that these types of funds exist. While all mutual funds turn over their holdings several times a year, they will not accomplish what you have in mind.

The only types of funds that attempt to make money in both bull and bear markets are long/short funds. I track some of them in my data base, but do not publish the results, since they have been less than impressive as far as long-term performance is concerned.

Year-to-date, they have been doing fairly well as you can see from the following table:

I have found that these funds tend to perform better during bullish periods than during bearish ones.

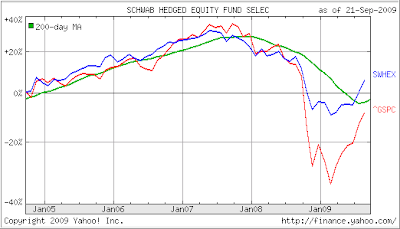

Take a look at this 5-year chart comparing SWHEX compared to the S&P; 500 (the green line represents the 200-day M/A):

As you can see, during this period SWHEX tracked the S&P; 500 fairly well, but still went down sharply as the bear struck with full force last year. The drop was considerably less than for the S&P; 500, but did not offer the type of protection that you might have expected.

You still would have been better off stepping aside via trend tracking in 2008 than taking a chance with a long/short fund. I hate to tell this, but a fund that automatically gives you the best of both worlds (locking in gains in bull and bear markets) simply does not exist.

You have to add your own exit strategy to any of your holdings to make sure you are protecting your portfolio from too much downside risk.

Comments 2

Ulli,

Does BEARX fall into the long/short category similar to the ones you listed?

Lucille,

No,BEARX is a short fund.

Ulli…