Yesterday, the markets repeated the behavior of the past few months which, a couple of days ago, I referred to as “back to normal.”

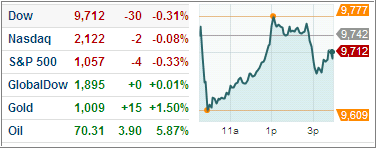

After a sharp sell off at the opening, the bulls stepped in and slowly but surely pulled the major indexes out of the doldrums and, for a short period, into positive territory. The gains did not hold, but the losses were minor compared to what could have been.

It was a volatile day to close out a quarter, which featured the S&P; 500 gaining 15%, its best quarterly performance since the end of 1998. Despite this impressive run, there is still a lot of making up to be done to overcome last year’s disaster when the markets collapsed and the S&P; 500 ended up losing 17% just in October 2008.

From current prices, the S&P; 500 still needs to gain another 19.8% just to get to the level we sold at on 6/23/08. Whether we will get there remains to be seen, but at least we made it through September with flying colors.

Of course, now we have October in front of us, a month which has also been known to wreak havoc with the markets. There is no need to become complacent; keep an eye on your trailing stop loss points, and be ready to act should this trend suddenly come to an end.