Sell stops were the main topic of the past couple of weeks as readers provided valuable feedback and asked for clarification.

Here are a couple more comments:

I learned from you that the trailing stop loss is usually 7% I do hold TIP (ETF). Does the same 7% hold for bond funds as well or should it be a lesser amount?

With bond funds being (in general) less volatile than stock funds, you can adjust the trailing top loss to some degree, maybe to the 4%-5% level; if you are more comfortable with that.

Personally, I have not held bond funds long enough to see if that makes much of a difference. The key is to have some exit point in place just in case this arena goes haywire.

One reader disagrees and had this to say:

I consider TIPs to be held and not sold under any condition for a retiree’s portfolio. I hold both the ETF and individual bonds.

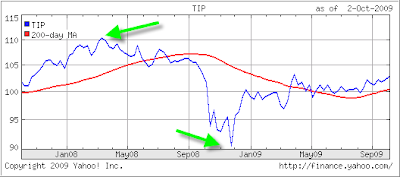

While you certainly can hold individual bonds for their duration, I don’t recommend that for any bond funds. In times of turmoil, bond funds can drop sharply as we’ve seen last year. Take a look at the chart for TIP:

From peak to trough, the drop was about 18%. Of course, with the benefit of hindsight, it does not seem such a big deal. But, while the price of TIP was approaching the $90 level in November of 2008, I’m sure that many investors were worried about further deterioration.

Unfortunately, we are living in an environment were anything can happen as far as investments is concerned. Last year should have taught everyone that lesson.

As the reader above stated “I consider TIPs to be held and not sold under any condition for a retiree’s portfolio,” I disagree and will have to take the opposite stance by saying that “there is no investment which should be held without an exit strategy.”