One reader has a portion of his portfolio invested in bond funds and is wondering if they still make sense. This is what he had to say:

Do you have any insights and advise for people who are currently holding bonds such as MWHYX and PTTDX in their portfolios? While both of these funds have performed phenomenally over the past decade is now the time to consider dumping them?

In the past I have always been a big believer in having a bond component in my portfolio, and it has served me well.

With interest rates set to rise, and a “bond bubble” having formed should investors dump these bond funds from their portfolios?

First, eventually the “bond bubble” will bring down the stock market, unless it is pulled off its current level by another trigger.

Second, we don’t have higher interest rates yet; they are merely a known factor lurking on the horizon with no specific time frame. The Fed announced last week that “accommodating” interest rates are here to stay for the time being—whatever that means.

To me, the solution, as to whether you should sell your bond funds or not, is very simple. Follow the trend! Apply the customary sell stop strategy to bond funds just as you would to equity funds.

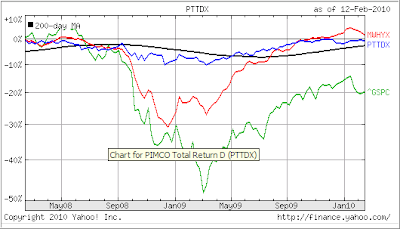

Take a look at the above chart in which I am comparing the funds you own with the S&P; 500. It’s obvious that your junk bond fund (MWHYX) tracks the S&P; 500 though with somewhat less volatility. The more diversified PTTDX has shown more stability during the downturn of 2008 and into 2009.

As a result, I suggest you use a 7% trailing stop loss for MWHYX and a lesser number, maybe 5% or so, for PTTDX. That way you don’t have to guess if now is a good time to sell or not. You simply let the market tell you when it’s time to exit.

Disclosure: I don’t have any positions in the funds discussed above.

Comments 1

I noticed that the Dollar dropped overnight from the 15th to the 16th, resulting in the now-familiar bounce in the markets and especially gold and silver. I was puzzled as to why it dropped, and then noticed a buried news story about China selling large amounts of short term Treasuries for the FIFTH MONTH IN A ROW! Several billions of dollars have changed hands, and I'd love to see the discounts the Chinese were offering. My guess is that this is what made the dollar drop so suddenly overnight. If true, then the market bounce today is standing on pretty weak legs. If China continues this path (why not?) and has to discount the Treasuries to unload them, will not the eventual effect be to raise interest rates in the U.S. markets, with the Fed following along as it usually does, after the fact? And might not this be one of the triggers to fuel the next major down leg in U.S. markets? It will be interesting to see if the precious metals stay ratcheted up after the markets start down, due to the higher interest rates.

I wonder if this sale of Treasuries by China might have an impact on the bond funds?

Tom C.