Judging by the emails I have received over the years, selling short when the markets tank has quite some attraction for aggressive investors.

I have commented before that looking at historical price points with the benefit of hindsight and determine that some of our sell signals would have provided a good shorting opportunity, does not tell the entire story. It does not account for the tremendous volatility, which would have stopped you out on several occasions assuming that you used a sell stop in the first place.

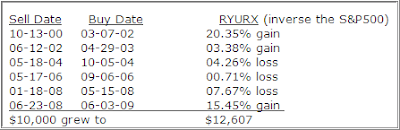

Reader Larry took it upon himself to test the shorting theory by using some of my sell signals to enter a short position and exit upon receiving a new buy signal. This is what he found:

I can’t say thanks enough for what you share with us readers in your weekly letter and daily blog.

Below is a back test I did for my own curiosity regarding using bear funds during your T.T.I. sell signals.

Using the sell dates on your chart that you publish each Friday and Yahoo Finance historical adjusted prices for splits and dividends I came up with the following results. A $10,000 original investment for example only was used in this back test.

Compounded annual growth rate 2.71% over the approx. 8.65 years.

While some cycles produced good results, others did not. Of course, Larry did not use any sell stop discipline, so it’s unknown if the weaker results might have turned out better or if the better results would have turned out worse.

In other words, he strictly used buy and hold in between the sell and buy dates. As I mentioned above, the results do not show the volatility or the DrawDown your portfolio would have experience to get to some of these gains.

Overall, the losses were fairly small, although three in a row over several years might have discouraged an investor to continue with this strategy. Nevertheless, I found Larry’s test very interesting and the overall positive result surprising.

Thanks for your efforts, Larry.

Comments 6

Ulli,

Here's a much more specific question, LOL. How do you handle the sell signal for something like PRPFX. I realize that most balanced funds are about 60-65% stocks and 35-40% bonds, but PRPFX has such different holdings, usually about 30% stocks including REITS, 30% bonds, 25% precious metals, and usually quite a bit (12% lately, I believe) in cash.

If the TTI gave a sell signal for domestic stocks funds, would you sell PRPFX? What if the bond funds were rated a "sell", but the stock funds were not?

Chuck,

We own PRPFX and are treating it like a sector fund. In other words, a sell gets generated either via a 7% trailing stop loss or the crossing of its price below its own long term trend line, whichever occurs first.

Ulli…

Thanks Ulli,

100 day m.a. or 200?

Although the gain was small, if you can eek out a small gain after a sell signal, then make gains when there is a buy signal, the combined results might be better than staying un-invested after a sell signal.

Using trailing stops could also improve or reduce results.

Chuck,

I use the 39-week M/A.

Ulli…

Thanks Ulli.