Why buy gold when platinum is rarer, dearer and far more useful claims Forbes in “Platinum: Like Gold, Only Better:”

Gold might have history on its side, but when it comes to investing in precious metals platinum arguably makes more sense. Platinum is rarer, dearer and just as pretty. What’s more, unlike gold, it has an important industrial use in automotive catalytic converters and LCD TV screens. If that weren’t enough to recommend the white metal, the launch of new exchange-traded funds makes platinum easier than ever to buy and sell.

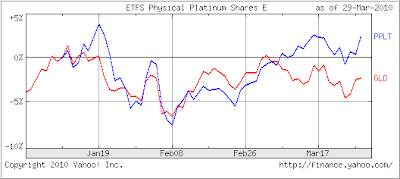

How does platinum compare to gold as an investment? It tends to trail its yellow sister when times are bad but outperform when industrial demand recovers. That’s been the case in the past three months, as platinum prices have outpaced gold’s by roughly 10 percentage points. These days, an ounce of platinum at $1,600 buys roughly 1.4 ounces of gold. That’s more than the average of 1.2 ounces last year, according to Bloomberg. Back in May 2008, an ounce of platinum bought 2.4 ounces of gold.

The ETF Securities Physical Platinum Shares (PPLT) fund is similar to the popular gold bullion SPDR Gold Shares ETF (GLD) in that it buys and holds raw bullion (safeguarded by JP Morgan Chase (JPM). Its shares track platinum’s spot price. You’ll incur lower transaction and storage fees in holding the ETF (annual expenses: 0.6%) than in holding and storing your own bullion bars.

Indeed, while this platinum ETF has been volatile (just like gold), it has been a better performer during the few months it’s been on the market. Take a look at the comparison chart:

Despite its short life span, volume has already soared to a daily average of some $25 million making it a feasible choice for most investors. If precious metals are of interest to you, be sure to read the entire link.

Disclosure: We currently have positions in GLD but not in PPLT.