For income investors, the recent past has been anything but kind. Ever since the Fed’s Quantitative Easing program, which started in September 10, interest rates have headed higher and bond prices have turned south.

Munis have been on a downward swing as well and may face more fundamental problems as States and Counties are mired in budget woes.

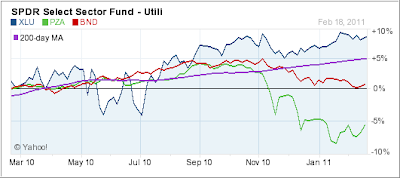

Bucking the trend so far have been utilities. In the above 1-year chart, I compared the total bond market (BND) with a well diversified, insured muni ETF (PZA), and one of the utility ETFs (XLU).

While utilities took a dip down back in May/June 10 (see chart above), when the S&P; 500 lost 16%, they currently seem to have regained upward momentum. Sporting a current dividend yield of 4.13%, XLU might be worthy of your consideration.

Here are a few other utility ETFs that I track in my data base: DBU, JXI, PUI, FXU, IDU and VPU. Check them out to see if they are a fit for your portfolio.

Disclosure: No holdings