- Moving the market

The Dow got off to a nice start with some early gains as traders kept rotating away from tech and into more economy-sensitive names like Walmart, Boeing, and GE Vernova, all of which moved higher.

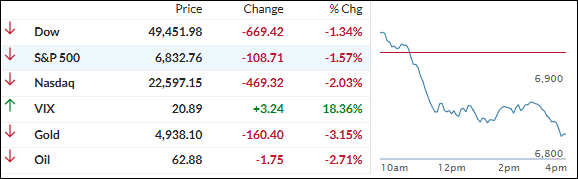

But that positive vibe didn’t last—the mood shifted, and the major indexes all dove back into the red by the close, with tech feeling the most pain.

The big catalyst was a fresh headline warning that AI could fully automate most tasks done by accountants, lawyers, and other professionals within the next 12–18 months.

That hit the Mag 7 hard, pushing mega-caps to their lowest levels in four months and leaving the group lagging the S&P 493 sharply on a year-to-date basis.

Yesterday’s strong jobs report (130,000 added vs. the expected 55,000, unemployment ticking down to 4.3%) had given a brief relief rally, but today’s action darkened the picture.

It muddies the Fed’s path—stronger labor data could mean fewer rate cuts if inflation stays sticky, putting even more focus on Friday’s CPI report before the long weekend.

Bond yields drifted lower all day, rate-cut expectations bounced back a bit, and the dollar ended flat. Bitcoin tagged $68K early before sliding back to the $65K area. The metals complex got dragged lower too, led by silver.

With tech getting slammed on AI disruption fears, the Dow holding up better in the rotation, and Friday’s CPI looming, does this feel like a normal healthy shakeout ahead of key data… or a sign that the market’s getting jittery and might need a clear inflation print to calm things down?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Dow opened with a nice little pop to the upside, but that early optimism didn’t last.

The bears took complete control pretty quickly and dominated every corner of the market. A headline about AI disruption seemed to open a trap door—every sector plunged hard, including the metals. There was really no place to hide today.

Our TTIs couldn’t escape the downdraft either. Both headed south, with the domestic one taking the bigger hit compared to the international TTI.

That said, they’re still comfortably sitting well above their long-term trend lines, so the bigger bullish picture remains intact.

This is how we closed 02/12/2026:

Domestic TTI: +7.50% above its M/A (prior close +8.93%)—Buy signal effective 5/20/25.

International TTI: +12.79% above its M/A (prior close +13.60%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli