- Moving the market

The major indexes opened with a nice pop after the January nonfarm payrolls report came in way stronger than expected: +130,000 jobs added vs. economists’ call for just +55,000.

That was also a big step up from December’s downwardly revised +48,000. It marked the best monthly gain in over a year, though the growth was heavily concentrated in health care (which added 124,000 positions—double its usual pace).

That said, there’s still the ongoing pattern of downward revisions throughout 2025 (average monthly job growth for the year was only +15,000 after all adjustments), so some traders are calling today’s number a potential outlier.

Rate-cut expectations dropped sharply on the back of the strong print.

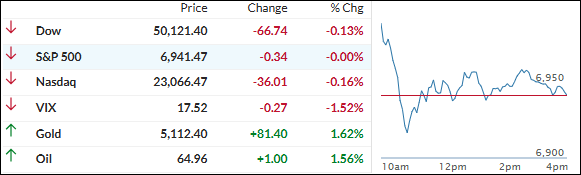

Early enthusiasm faded fast—the indexes dove into the red mid-session, tried to claw back, but ultimately closed basically flat.

The Mag 7 underperformed the rest of the S&P 493 again, bond yields rallied higher, and the dollar slipped for the fourth straight day.

Bitcoin dipped but bounced off the $65K level. The metals provided the real lift: gold held firm above $5,100, and silver jumped over 4%, giving our portfolios a nice cushion despite the equity drag.

It’s a great example of how commodities can act as solid insurance when stocks go sideways.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day started with some real enthusiasm after the strong jobs report, but that excitement evaporated fast.

The major indexes spent the rest of the session just drifting around the flat line—up a little, down a little, back, and forth. In the end, it was classic treading water: no big moves, no clear direction.

The one bright spot?

The metals had another good day and kept shining while everything else just hung around.

Our TTIs bucked the overall indecision and closed moderately higher, which keeps our current bullish outlook looking solid and intact.

This is how we closed 02/11/2026:

Domestic TTI: +8.93% above its M/A (prior close +8.74%)—Buy signal effective 5/20/25.

International TTI: +13.60% above its M/A (prior close +13.14%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli