- Moving the market

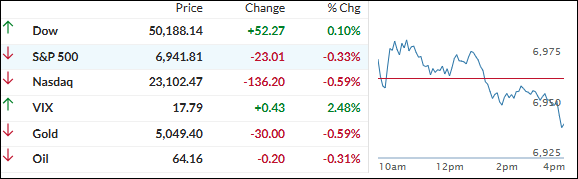

Stocks kicked off the day with some nice early lift, and the Dow even tagged another all-time high as traders rotated into software names and more value-oriented areas.

The Dow closed up about 0.5%, getting a solid boost from Disney (entertainment) plus financials like American Express and Goldman Sachs.

The broader market got some help from software stocks, which had been hammered last week. Datadog bounced 15% and ServiceNow added 4%—decent rebounds.

But the rally lost steam later on: the S&P 500 and Nasdaq faded and ended up in the red.

Retailers like Costco and Walmart slipped roughly 1% each after the December retail sales report came in flat (missing the expected +0.4% gain). That followed November’s +0.6% increase, so consumer spending is looking a bit softer.

Bond yields eased back, the dollar limped lower, and the Citi Economic Surprise Index corrected a bit.

Precious metals held their ground: gold bounced around above $5,000 the whole session, silver stayed steady near $80, and Bitcoin showed early strength but faded, losing its $70K level.

ZH summed it up best: Traders are now locked and loaded for Wednesday’s big jobs report—everyone’s watching to see if the numbers are noisier and less meaningful than usual after the recent disruptions.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Dow was the only one that kept its early positive vibe going and carried it all the way to the close.

The S&P 500 and Nasdaq, though, saw the mood flip fast—both plunged into the red and stayed there.

Even the metals and bitcoin couldn’t muster much; they just drifted aimlessly with no real direction.

Our TTIs held up nicely through all the uncertainty—both scored moderate gains and kept the overall bullish tone intact.

This is how we closed 02/10/2026:

Domestic TTI: +8.74% above its M/A (prior close +8.35%)—Buy signal effective 5/20/25.

International TTI: +13.14% above its M/A (prior close +12.91%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli