- Moving the market

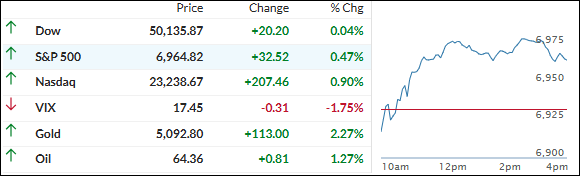

After a weak open, the major indexes shook off the early blues and found solid footing, heading into positive territory for a nice green close.

Traders were mostly focused on waiting for big upcoming data (delayed January jobs report Wednesday) and another wave of earnings, following last week’s volatility.

Oracle jumped 8% after getting upgraded to Buy on fresh optimism around OpenAI and its ecosystem beneficiaries. Fellow chip names kept the momentum going too—Nvidia and Broadcom each extended Friday’s gains, up almost 3% and more than 1%, respectively.

The delayed January jobs report (pushed back by the government shutdown) is due Wednesday, with economists expecting around +55,000 nonfarm payrolls after last week’s weak ADP print of just +22,000.

Friday brings the January CPI, with consensus looking for a 2.5% annual rate.

It turned into a classic “buy everything” kind of day—small caps outperformed, Big Tech held strong, the Dow clung to its 50,000 level, and the Mag 7 actually outperformed the rest of the S&P 493 for a change.

Most shorted stocks kept Friday’s ramp alive (now up 11% over two days), and US Growth beat US Value for the second straight session.

Bond yields slipped, the dollar continued Friday’s sell-off, but commodities stayed firm—silver led again, gold nearly recaptured $5,100, and Bitcoin chopped around before climbing back above $71K.

With the Nasdaq staying strong, metals continuing to lead, and the international TTI pulling ahead, this feels like a healthy broadening of the rally across regions and asset classes.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Friday’s rally kept rolling right into the new session, with the Nasdaq leading the charge and setting the pace while the Dow trailed a bit behind. The major indexes all closed higher—solid continuation.

The real standouts again? The metals.

Gold and silver outperformed the stock indexes handily, and copper joined in with a nice solid advance too.

Our TTIs rode the wave as well—both posted gains, but the international one clearly took the lead and outpaced its domestic counterpart by a good margin.

This is how we closed 02/09/2026:

Domestic TTI: +8.35% above its M/A (prior close +8.29%)—Buy signal effective 5/20/25.

International TTI: +12.91% above its M/A (prior close +11.99%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli