- Moving the market

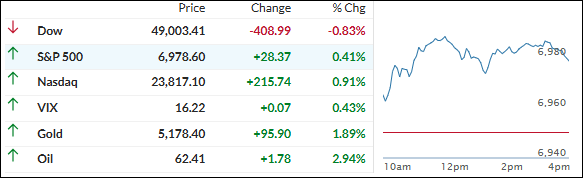

The S&P 500 and Nasdaq jumped early, powered by solid gains in Big Tech, as traders positioned for a packed week of earnings reports and the Fed’s first policy meeting on Wednesday. The Dow, however, stumbled out of the gate and stayed under pressure.

Big Tech names led the charge: Apple climbed nearly 2%, Microsoft added 1.3%, and the whole sector got a boost from anticipation around upcoming results. More than 90 S&P 500 companies report this week, including Meta, Microsoft, and Tesla on Wednesday, and Apple on Thursday.

Health insurers were the big laggards—Humana tanked 18% and CVS Health dropped 10% after CMS proposed only a tiny 0.09% average net increase in Medicare Advantage payments for 2027. That was a gut punch for the sector.

The Fed meeting is the main event ahead—markets are widely expecting rates to stay steady in the 3.5%–3.75% range, but everyone’s hunting for clues on future cuts. Futures still price in about two quarter-point reductions by year-end 2026.

Late in the day, President Trump dropped some off-the-cuff remarks saying the dollar was “doing great” and he didn’t think it had weakened too much. That added a little extra pressure on the currency, helping precious metals push higher.

The S&P 500 tagged a new record high intraday but couldn’t quite break through 7,000 and faded into the close.

Bond yields were mixed, the dollar softened, but gold kept charging—making several runs at$5,100 before finally clearing it for a new high.

Silver was choppier but clawed back to recapture the $110 level late. Bitcoin did its usual dance, ending near $89K after testing higher.

Once again, the precious metals surge turned what could’ve been an average day into a really strong one for our portfolios.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls were in full control from the opening bell to the close, pushing most of the major indexes to solid gains.

The S&P 500 even notched a new all-time high intraday (though it couldn’t quite punch through the 7,000 level), while the Dow was the only one that lagged a bit.

Our TTIs had a split day: the domestic one slipped just a tad, but the international TTI stepped up and posted a nice advance.

This is how we closed 1/27/2026:

Domestic TTI: +7.40% above its M/A (prior close +7.56%)—Buy signal effective 5/20/25.

International TTI: +11.45% above its M/A (prior close +10.38%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli