- Moving the market

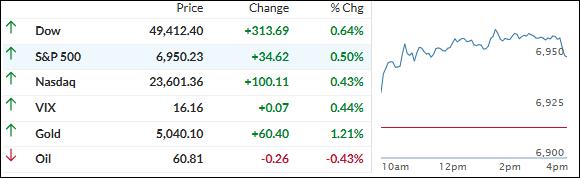

The major indexes opened strong and kept the upward momentum rolling all session long, even as traders kept one eye on political headlines and braced for a busy week ahead (big earnings wave + the next Fed meeting).

Over the weekend, President Trump threatened a 100% tariff on Canadian goods if Ottawa strikes a trade deal with China. Canadian PM Mark Carney quickly shot back that they have “no intention” of pursuing one with Beijing.

The situation’s fluid, but most folks aren’t losing sleep over it actually happening—still, the constant tariff saber-rattling is slowly wearing on sentiment.

Washington chatter added to the noise too: growing outrage over federal immigration agents fatally shooting a U.S. citizen in Minnesota (second time this month) has people whispering about another potential government shutdown.

Wall Street’s main focus this week is earnings season kicking into high gear—more than 90 S&P 500 companies report, including Meta and Microsoft on Wednesday and Apple on Thursday. So far, the season’s been solid, with 76% beating expectations.

By the close, bond yields pulled back, the dollar broke down to its lowest since March 2022, and equities stayed in rally mode—except small caps, which lagged.

The Mag 7 found their groove again and outperformed the rest of the S&P 493 for the second day running.

Bitcoin bounced nicely today after some weekend selling, clawing back toward recent levels.

The real fireworks?

Precious metals once again. Silver exploded as high as $117 (+12% intraday) before pulling back to $107, while gold blasted past $5,000 and closed above it (up ~1.4% after the fade), giving our portfolios a nice boost.

Silver’s +65% month-to-date run to fresh records stands in stark contrast to heavy ETF and speculator selling—Bloomberg’s question is spot-on: who’s actually buying this latest leg higher, and how sustainable is it?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets opened strong and just kept rolling with that positive energy all session long—no real pullbacks, just steady buying from start to finish.

The major indexes locked in a solid win, but honestly, they looked tame compared to what was happening in the precious metals corner.

Gold, silver, and the crew were the real stars—putting up some serious gains and stealing the show once again.

Our TTIs rode the bullish wave perfectly too. Both moved higher with moderate, but very satisfying advances.

This is how we closed 1/26/2026:

Domestic TTI: +7.56% above its M/A (prior close +7.31%)—Buy signal effective 5/20/25.

International TTI: +10.38% above its M/A (prior close +9.84%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli