- Moving the market

Stocks bounced higher Wednesday after President Trump assured global leaders at the World Economic Forum in Davos that he would not use force to acquire Greenland—a geopolitical worry that had been unsettling markets and pressuring the dollar.

His comments sparked relief across risk assets, helping equities catch a bid and calming some of the week’s tension.

Trump, addressing U.S. military and financial commitments to NATO, said, “I don’t have to use force. I don’t want to use force. I won’t use force.” The 10-year Treasury yield dipped as safe-haven demand eased, while the dollar index clawed back early losses to finish in the green.

That said, even as he ruled out military action, Trump kept things interesting by announcing he would “seek immediate negotiations” on buying Greenland—a topic that still appears very much alive.

He also reiterated his push for Congress to implement a nationwide 10% cap on credit card interest rates, a plan facing stiff opposition from lawmakers.

The constant stream of headlines kept traders on their toes. European lawmakers responded by suspending the EU-U.S. trade deal reached last summer, citing tensions over tariffs tied to the Greenland dispute.

Trump, meanwhile, confirmed new tariff hikes on goods from eight NATO members—starting at 10% on February 1 and rising to 25% by June 1—unless an agreement is reached.

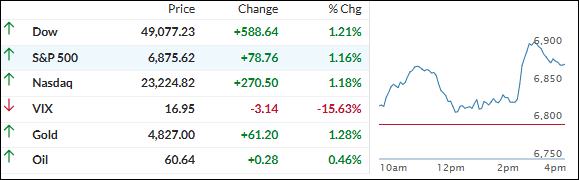

Markets swung wildly on the news: an early rally gave way to a midday drop before bouncing back late as Trump’s tone softened.

The Mag 7 stocks moved sharply relative to the rest of the S&P 500, while bond yields eased but rate‑cut bets slumped.

Bitcoin spiked wildly, ripping higher on Trump’s wavering tone. Gold set yet another record high before reversing some gains but still finishing higher, while silver finally cooled off with a modest pullback.

If the first few weeks of 2026 are any guide, it looks like we’re in for a headline‑driven roller coaster—and the key to surviving it may come down to smart diversification and a disciplined exit plan.

The only question is: will markets find their footing soon, or is volatility the new normal?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

A flurry of headline-driven chaos kept traders on edge today, with an early rally fizzling out by midday—only to roar back late in the session and push the major indexes solidly into the green by the close.

Our TTIs bounced along with the market, with the domestic index showing a particularly strong improvement, a welcome sign that underlying momentum is regaining its footing.

This is how we closed 1/21/2026:

Domestic TTI: +8.15% above its M/A (prior close +6.35%)—Buy signal effective 5/20/25.

International TTI: +9.72% above its M/A (prior close +8.84%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli