ETF Tracker StatSheet

You can view the latest version here.

SILVER OUTSHINES AGAIN, BITCOIN HAS STRONGEST WEEK IN MONTHS

- Moving the market

The major indexes opened lower and stayed soft, as traders digested President Trump’s latest Fed chair comments.

He basically said National Economic Council Director Kevin Hassett might stay in his current role as top economic advisor instead of replacing Jerome Powell (whose term ends in May). That shifted prediction markets—former Fed Governor Kevin Warsh jumped ahead as the new frontrunner.

The pullback came after yesterday’s winning session, powered by chip stocks and Taiwan Semiconductor’s blowout Q4 report (35% profit jump). That momentum carried over from the U.S.-Taiwan trade deal announcement, where Taiwanese chip/tech companies committed to at least $250 billion in U.S. production capacity.

The week was a whirlwind: AI optimism resurged, geopolitical noise (Iran unrest, Greenland talks) flared up, tariff chatter continued, Fed independence worries bubbled, and earnings season started choppy.

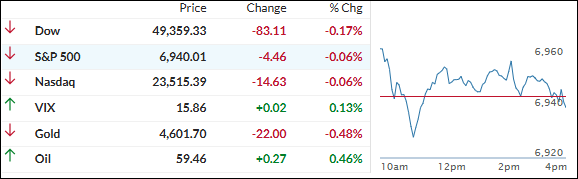

Small caps soared on a massive ongoing short squeeze, the Dow and S&P dipped a touch, and the Nasdaq lagged. The Mag 7 once again underperformed the other 493 S&P names.

Bond yields rose, the dollar swung wildly but finished the week flat, gold rallied for the fifth week in six (despite today’s dump-and-pump), copper eased, but silver massively outperformed (+11%).

Bitcoin had its best week in three months, surging to a two-month high before settling around $95K.

After all the geopolitical headlines and a soft close like today, it feels like the market’s just taking a well-deserved breather… or could the uncertainty linger a bit longer into the new year?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

We opened on a positive note with a little early bounce, but the momentum fizzled fast.

Bullish energy was basically nowhere to be found, so the major indexes drifted lower all session and closed only slightly in the red. It was a quiet, uneventful day that capped off a week filled with geopolitical jitters.

Our TTIs gave back a bit of their recent gains too, but nothing serious—they’re still comfortably above their long-term trend lines and firmly in bullish territory for the week overall.

This is how we closed 1/16/2026:

Domestic TTI: +7.96% above its M/A (prior close +8.82%)—Buy signal effective 5/20/25.

International TTI: +10.14% above its M/A (prior close +11.13%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli