- Moving the market

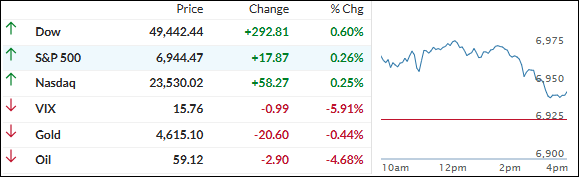

The major indexes jumped right out of the gate, with banks and tech leading the charge as Wall Street shook off back-to-back losing days.

The real spark came from Taiwan Semiconductor (TSMC) dropping another monster quarter—profit up 35% year-over-year—which lit a fire under the AI trade and boosted investor confidence.

Chip stocks were on fire: the VanEck Semiconductor ETF (SMH) climbed 3%, Nvidia and Micron each added more than 2%, and the whole sector rode the wave.

This happened even after President Trump signed a 25% tariff on certain semiconductors (though chips tied to U.S. tech supply-chain buildout are exempt—so markets mostly shrugged).

Oil prices helped too—Brent and WTI both slid more than 4%, easing inflation worries. Plus, jobless claims for the week ending Jan. 10 came in at 198,000 (better than the 215,000 expected), giving the jobs market another thumbs-up.

Small caps outperformed big time (thanks to another juicy short squeeze), even as bond yields ticked higher. The dollar did its usual pump-and-dump and ended flat.

Metals took a breather after recent fireworks—silver touched a new intraday high of $93.75 early but swung wildly and closed about unchanged. Bitcoin tested $98K overnight before fading back to $96K.

So, what’s the biggest risk for the global economy and markets in 2026? Goldman Sachs points to geopolitics as the top threat… but if history’s any guide, it’ll probably be something nobody saw coming.

With chip stocks roaring back, small caps squeezing shorts, and metals still holding strong despite a breather, this feels like the risk-on momentum is building again for 2026.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

For a change, the metals complex took a step back, giving stocks room to take the spotlight.

All the major indexes opened strong and held onto those gains throughout the day, keeping bullish sentiment alive from start to finish.

Our TTIs also moved higher, widening the gap above their respective trend lines — a good sign that the market’s underlying momentum is still pointing in the right direction.

This is how we closed 1/15/2026:

Domestic TTI: +8.82% above its M/A (prior close +8.34%)—Buy signal effective 5/20/25.

International TTI: +11.13% above its M/A (prior close +11.01%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli