- Moving the market

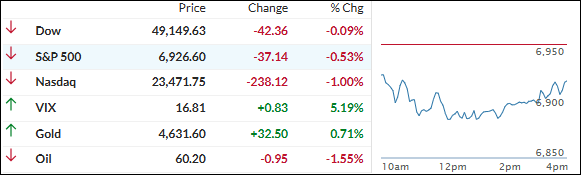

Stocks opened lower for the second straight day, pulling back further from recent record levels as traders chewed on a fresh batch of earnings reports and kept one eye on geopolitical headlines.

Wells Fargo was a big laggard, dropping more than 5% after posting weaker-than-expected Q4 revenue. Bank of America and Citigroup slipped too—even though they beat estimates—because the results weren’t strong enough to keep the market excited near all-time highs.

That added to their pain from Trump’s Friday call for credit card interest rate reform; Wells and BofA are both down roughly 7% for the week, Citigroup more than 6%.

Geopolitical noise didn’t help either: oil rose for a fifth day on worries about supply disruptions from civil unrest in Iran (a key OPEC player) and rising U.S.-Iran tensions. Plus, crunch talks are happening today between the Trump administration and officials from Greenland and Denmark over U.S. control of the territory.

By the close, those pressures kept the major indexes in the red, with the Nasdaq taking the hardest hit, the Dow holding up best, and small caps managing a small green finish.

The real bright spot?

Commodities kept shining. Silver exploded over 7% to punch through $92, gold flirted with all-time highs and closed above $4,600, copper added a solid +1.6%, and Bitcoin finally joined the party, climbing to a two-month high of $97.5K and eyeing $100K.

The commodity sector continues to steal the show almost every day—definitely the place to be right now.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Right from the opening bell, the bullish mood was nowhere in sight. The major indexes slithered into the red pretty quickly, with the Dow holding up the best (it didn’t drop as hard as the others).

The rest of the session felt like a slow bleed—nothing dramatic, just steady pressure.

The real action was in the commodities corner. Gold, silver, copper, and bitcoin all powered higher with solid gains—nice to see the hard assets and crypto doing their own thing while stocks struggled.

Our Trend TTIs bucked the broader weakness (especially in tech) and actually managed to close in the green. Small win, but a win.

This is how we closed 1/14/2026:

Domestic TTI: +8.34% above its M/A (prior close +7.85%)—Buy signal effective 5/20/25.

International TTI: +11.01% above its M/A (prior close +10.44%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli