- Moving the market

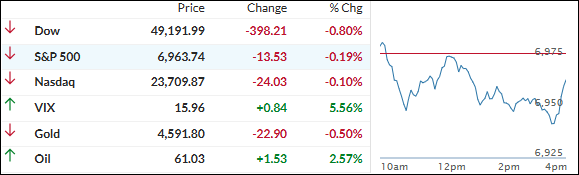

The market opened lower and pretty much stayed that way, dragged down early by JPMorgan Chase.

Traders were digesting the latest CPI inflation data (core up 0.2% MoM and 2.6% YoY—both below estimates) while weighing President Trump’s push for a one-year 10% cap on credit card interest rates.

JPMorgan’s CFO basically said the industry might fight back hard, sending the stock down more than 2%. Goldman Sachs followed with a 1%+ drop, and payment giants like Mastercard and Visa each slid around 5%.

The CPI reading (plus last week’s softer jobs report) reinforced the idea that the Fed might hold off on rate cuts at their next meeting. No big surprise—equities couldn’t shake the pressure.

In the end, the major indexes closed modestly lower. Bond yields eased, the dollar chopped sideways, and while Bitcoin and some metals finished higher, they all came off intraday highs.

Mega-caps did their usual dump-pump-dump routine with no clear direction. Gold touched a new record high before fading, and silver stole the spotlight again, topping $89 for the first time and closing up almost 2%.

To me, it feels like when stocks and most assets are drifting aimlessly, but silver’s still smashing records, the hard-asset bull is just doing its own thing… while the broader market might be getting a little tired and needs a fresh catalyst soon.

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

We started the day with a nice little bounce—things looked promising early—but that positive vibe didn’t last.

Bearish sentiment took over pretty quickly, the early gains evaporated, and the major indexes drifted lower to finish with a moderate red close.

Pretty much everything felt directionless and wobbly across the board… except silver, which powered through and hit a brand-new record high. That metal just keeps doing its own thing.

Our TTIs mirrored the uncertainty—they basically treaded water all session, going nowhere in particular.

This is how we closed 1/13/2026:

Domestic TTI: +7.85% above its M/A (prior close +7.85%)—Buy signal effective 5/20/25.

International TTI: +10.44% above its M/A (prior close +10.33%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli