- Moving the market

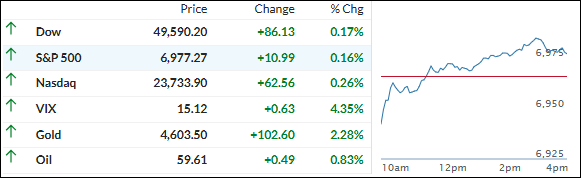

Stocks stumbled out of the gate Monday after news broke that the Department of Justice had opened a criminal investigation into Fed Chair Jerome Powell, marking what many see as an escalation in President Trump’s ongoing effort to pressure the central bank.

The headlines sparked a broad selloff early on, with the Dow down nearly 500 points and the S&P 500 off about 0.5% at the day’s lows.

Still, the market managed to recover some ground as the session wore on, led by Small Caps, and boosted by solid moves in Walmart and a few large tech names.

Even so, traders were uneasy with Trump’s separate proposal to temporarily cap credit card interest rates at 10%, a move aimed at easing costs for consumers that critics say could choke off lending and hurt banks’ bottom lines.

The uncertainty pushed investors toward safe havens. Gold surged more than 2%, while silver absolutely stole the spotlight, rocketing nearly 7% to a record high above $85.

Copper added more than 2%, though it remained overshadowed by silver’s breakout. The dollar slumped sharply, rate‑cut odds dropped, and bond yields crept higher.

Interestingly, the “Mag 7” finally showed some staying power, outperforming the rest of the S&P 500’s 493 stocks for the first time in a while.

Meanwhile, Bitcoin finished the day higher after whipsawing in a wild pump‑and‑dump‑and‑pump sequence that mirrored the broader market’s volatility.

As traders look ahead, many believe the next major driver will come from AI‑related capital spending by large cloud providers — but with metals flying, the dollar slipping, and the Fed caught in political crossfire, could this uneasy mix evolve into the year’s first major turning point for markets?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks opened lower but didn’t stay there for long. After a shaky start, the major indexes turned things around, with Small Caps leading the rebound and helping the market build steady upside momentum through the day.

Once again, the metals stole the show, handily outperforming as traders kept gravitating toward hard assets for stability and growth potential.

Our TTIs held firm and even edged up slightly, signaling that the market’s underlying trend remains intact and positive.

This is how we closed 1/12/2026:

Domestic TTI: +7.85% above its M/A (prior close +7.75%)—Buy signal effective 5/20/25.

International TTI: +10.33% above its M/A (prior close +10.03%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli