- Moving the market

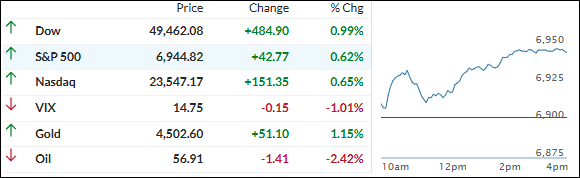

The Dow kicked things off strong, building on yesterday’s record close after the Venezuela news (U.S. capture of Maduro and Trump pushing U.S. oil companies to invest big).

Early gains held pretty well, with energy names like Chevron (up ~4%) leading the charge on hopes of rebuilding Venezuela’s massive oil infrastructure.

The other majors followed the upbeat mood and kept momentum going, though the Mag 7 (including Nvidia +1% early) started hot but faded late, letting the S&P 493 take the win again. A huge short squeeze kept small caps flying (up big over two days).

Traders are eyeing this week’s data (ADP payrolls Wednesday, full jobs report Friday) for more clues on the Fed’s path.

The standout? Metals kept their 2026 hot streak alive—silver +6.6% to top $80 (new highs), gold aiming for $4,500, platinum and copper strong too. Bond yields higher, dollar modest comeback, Bitcoin around mid-$90K range.

When stocks keep grinding higher but silver’s the one smashing records left and right, does it feel like the ultimate risk-on harmony… or a gentle nudge that our hard-asset tilt is still doing the heavy lifting?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bulls stayed in full control all session long, pushing the major indexes to another solid green close—no drama, just steady gains from open to bell.

The real excitement, though, was once again in the metals corner. They all climbed nicely, but silver stole the show (as usual lately) by blasting to a fresh record high around $82. Love seeing that kind of firepower.

Our TTIs didn’t miss the party either—both moved higher, with the domestic one putting up a particularly big win today.

This is how we closed 1/06/2026:

Domestic TTI: +7.99% above its M/A (prior close +6.70%)—Buy signal effective 5/20/25.

International TTI: +10.92% above its M/A (prior close +10.33%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli