- Moving the market

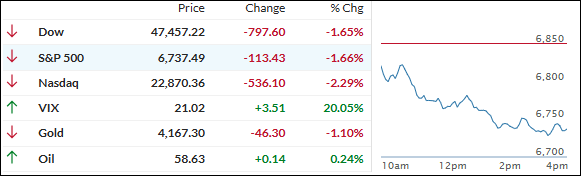

Today was the classic “buy the rumor, sell the fact” type of session: markets opened lower and just kept sliding, even as the long-awaited government re-opening failed to inspire the bulls.

Tech and AI names took the brunt of the selling, with the Nasdaq locking in its third straight decline, led down by heavyweights like Nvidia, Broadcom, and Alphabet.

This week’s action shows a clear split—while health care and other value sectors managed to hold up earlier in the week, today everything went south, partly because traders were left flying blind with no new jobs or inflation data following the extended government pause.

The lack of fresh economic reports left everyone guessing about the Fed’s next move and increased anxiety about the rate outlook.

AI favorites in the Mag 7 basket got whacked for a third straight day, while rising bond yields and a sliding dollar couldn’t keep gold shining; even the precious metal dipped, though not nearly as much as stocks, and remains solidly up year-to-date.

Bitcoin lost its $100k handle before bouncing at $107k.

Is this growing caution just a temporary blip, or does it mark a shift to a rougher, more uncertain market as year-end approaches?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Red flashed through the markets from the opening bell, as all the major indexes took a swift nosedive and never recovered their footing.

Tech and AI shares—think Nvidia, Broadcom, and Alphabet—helped power the drop as investors rotated out of high-valuation stocks in response to rising Treasury yields and uncertainty over missing inflation and jobs data after the lengthy government shutdown.

Even the metals, which often offer a haven during rough stretches, joined the selloff—but losses there were notably more moderate.

Our TTIs echoed the broader market mood, with the domestic one posting a steeper decline than its international cousin as value sectors held up better than tech.

This is how we closed 11/13/2025:

Domestic TTI: +4.93% above its M/A (prior close +6.13%)—Buy signal effective 5/20/25.

International TTI: +11.07% above its M/A (prior close +11.74%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli