- Moving the market

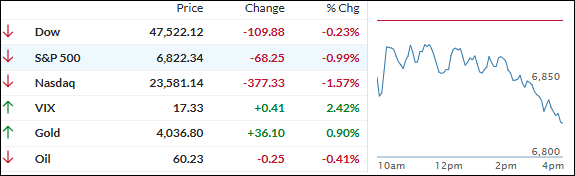

Stocks slipped early on as tech earnings took center stage, with the S&P 500 and Nasdaq both retreating from recent highs.

Alphabet provided a bright spot by rallying about 5% on better-than-expected results, but Meta Platforms and Microsoft tumbled roughly 12% and 2%, respectively, after their quarterly reports triggered investor worries over rising spending forecasts and soft profit figures.

The rotation out of mega cap tech—especially artificial intelligence leaders like Nvidia—meant under-the-radar sectors and the broader market held up better.

All eyes were also on Washington and Beijing after President Trump and Chinese President Xi Jinping wrapped up a meeting that included a new deal: the U.S. agreed to cut tariffs on Chinese fentanyl to 10%, with pledged action from China to curb shipments and boost agricultural buys, plus a one-year delay to rare earth export curbs.

Despite the hoped-for trade progress, hawkish remarks from Fed Chair Jerome Powell about December rate cuts kept investors on edge.

Powell made it clear that another reduction is “far from a foregone conclusion,” sending bond yields and the dollar higher, while Bitcoin and most major asset classes lost ground except for gold and silver, which managed to notch solid gains of 1.96% and 2.59% respectively.

The day proved a wild ride, with our portfolios rescued by precious metals as tech giants disappointed.

Will coming earnings help shake off the Fed’s tough stance and spark a new rally, or is a bumpy stretch ahead as trepidation grows going into the year-end?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks kicked off the trading day on a sleepy note, with only the Dow managing to stay in the green while the S&P 500 and Nasdaq spent the session stuck in negative territory.

The tech sector took the hardest hit, dragged lower by a sharp sell-off in Meta and cautious trading ahead of more big tech earnings. By contrast, the broader market held up a bit better as traders rotated into non-tech names.

After yesterday’s big swings, our TTIs couldn’t shake the bearish mood and ended the day on the downside.

This is how we closed 10/30/2025:

Domestic TTI: +4.93% above its M/A (prior close +5.38%)—Buy signal effective 5/20/25.

International TTI: +11.06% above its M/A (prior close +11.89%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli