- Moving the market

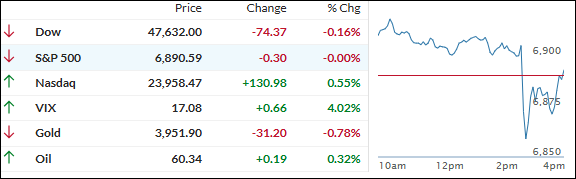

Stocks took off in early trading today, hitting record highs as traders cheered the Feds widely anticipated rate cut and yet another tech sector rally.

Nvidia led the pack, soaring over 4% and making Wall Street history by becoming the world’s first $5 trillion company, fueled by relentless demand for AI chips. AMD and Micron piggybacked on the momentum, each logging solid gains as well.

The S&P 500 briefly topped 6,900 for the first time ever, underscoring just how much optimism is baked in this week.

Traders were riding high early on, expecting a dovish follow-through from Fed Chair Powell after the central bank delivered a telegraphed quarter-point rate cut and ended quantitative tightening as predicted.

But Powell threw a curve ball not long after, warning that another cut in December was “far from certain.” That took some wind out of the market’s sails, instantly flipping much of the green to red.

Rate-cut odds for December tumbled from over 95% to near 65%, with the selloff hitting just about every asset class except the tech-heavy Nasdaq.

Bond yields popped alongside the dollar, gold gave back early gains, but silver bucked the downtrend and closed higher. Bitcoin stumbled. Meanwhile, the most-shorted stocks extended their losing streak, but it was Nvidia’s historic run that really stole headlines.

After a rollercoaster session like today’s, will the market find its footing on clearer economic data or does the volatility stick around as 2025 winds down?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks kicked off Wednesday in rally mode, fueled by hopes that the Fed would deliver another rate cut—and Chair Jerome Powell did just that, lowering rates by a quarter point as most had expected.

However, the good vibes didn’t last: during his press conference, Powell threw cold water on the idea of a December cut, saying it was “not a foregone conclusion.” That sent markets into reverse, erasing early gains almost everywhere except the tech-heavy Nasdaq.

Our TTIs lost steam too, pulling back from their recent highs alongside the shifting mood on Wall Street.

This is how we closed 10/29/2025:

Domestic TTI: +5.38% above its M/A (prior close +6.57%)—Buy signal effective 5/20/25.

International TTI: +11.89% above its M/A (prior close +12.29%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli