- Moving the market

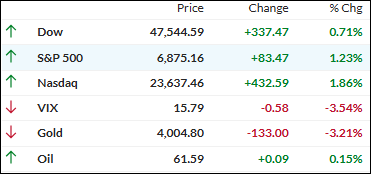

Stocks kicked off the week with a bang, hitting new record highs after U.S. and Chinese officials announced a breakthrough in trade talks over the weekend.

The early rally never fizzled, with all three major indexes closing at all-time highs and the Nasdaq leading the way, up nearly 2% thanks to a surge in chip stocks like Nvidia.

Driving optimism was news that President Trump and President Xi Jinping are expected to formalize a trade deal this week.

The proposed framework includes a one-year delay on China’s rare earth export curbs, a halt to Trump’s threatened 100% tariffs that were set to begin in November, resumed Chinese purchases of U.S. soybeans, progress on the TikTok dispute, and possible cooperation on fentanyl.

While the finer points are still being worked out, the mood on Wall Street was positive, with traders betting the truce will hold and pave the way for lower trade barriers moving forward.

Meanwhile, traders are also eyeing Wednesday’s expected Fed rate cut, which could offer another tailwind for equities after last week’s tamer inflation data.

Gold cooled but held its ground near $4,000, silver dipped, and bitcoin staged a weekend rally past $115,000. Bond yields were choppy as the 10-year tested the 4% mark again, and the dollar edged lower.

With bulls firmly in control and a trade deal seemingly within reach, will these new highs stick—or are we in for another surprise as world leaders finalize their agreement?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The markets started the week on a high note, maintaining strong upside momentum throughout the session as optimism over a fresh US-China trade deal powered all three major indexes to new record highs.

International equities got an even bigger lift, as global investors responded to the prospect of a near-term deal by piling back into risk assets—helping our international TTI outperform its domestic counterpart for the day.

This is how we closed 10/27/2025:

Domestic TTI: +7.50% above its M/A (prior close +7.02%)—Buy signal effective 5/20/25.

International TTI: +12.50% above its M/A (prior close +11.39%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli