- Moving the market

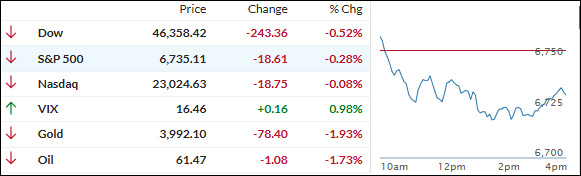

The markets got off to a hot start, with the S&P 500 and Nasdaq hitting fresh all-time intraday highs early on, but things fizzled as the session wore on and all three major indexes slipped into the red by the close—though some late dip buying helped trim those midday losses.

On the bright side, Costco’s stock popped 2% after it delivered another round of strong September sales, and Delta Air Lines soared 6% on upbeat earnings and an improved outlook.

Despite yesterday’s eight-out-of-nine winning streak for the S&P 500 and the Nasdaq’s historic jump over 23,000, today was a different story.

With no big economic reports thanks to the government shutdown, all eyes were on the Fed, as traders listened in on Chair Powell and other officials for hints about the next move following Wednesday’s split Fed minutes.

Nearly everything moved lower, except the dollar—which rallied to a two-month high and dragged down gold and silver, both of which lost their grip on record territory after early surges.

Even the “Mag 7” tech giants only managed to claw back to unchanged after a rough patch.

Bitcoin wandered lower while bond yields ticked up. Are today’s broad losses just a bump in the road, or is more volatility about to hit?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Everything finally moved together today, but unfortunately, it was all in the wrong direction—nearly every asset class slipped lower, with only copper and silver managing to squeak out small gains.

Our TTIs weren’t spared either, finishing the day down, though both are still firmly planted in bullish territory.

This is how we closed 10/09/2025:

Domestic TTI: +6.52% above its M/A (prior close +7.41%)—Buy signal effective 5/20/25.

International TTI: +11.52% above its M/A (prior close +11.98%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli