- Moving the market

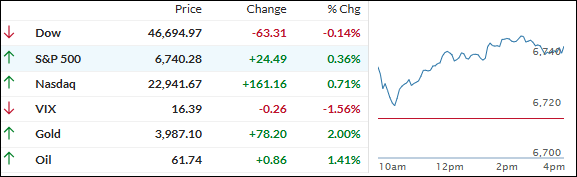

The S&P 500 and Nasdaq kicked off the day with gains and managed to hold onto them, while the Dow just kind of drifted below the flatline from the open to the close.

The real action was in the tech space, where AMD soared over 20% after striking a deal with Sam Altman’s AI group—a move that could net the ChatGPT company a 10% stake in AMD down the road.

The chipmaker will roll out a set of new GPUs over several years, and the news put some heat on Nvidia, which saw pressure in the premarket.

Traders didn’t seem too bothered by the government shutdown, now rolling through its second week after lawmakers failed yet again to find common ground on funding.

The shutdown also meant key economic reports, like the September jobs data, stayed off the calendar Friday. Even with less data to chew on, Fed speakers—including Governor Miran on Wednesday and Chair Powell on Thursday—are still on deck and could set the tone for the week.

Meanwhile, it was another big session for gold, silver, and bitcoin. Gold notched an all-time high, edging close to the $4,000 mark, while silver added 1.2% to cruise toward $49.

Bitcoin blew past its old record, spiking above $126,000 before settling back a bit. Could the run in metals and crypto have more room to go, or are things getting a bit stretched?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Both the S&P 500 and Nasdaq picked up speed after a strong start, easily adding to their early gains while the Dow struggled to keep up.

Among our trend indicators, the domestic reading barely budged, just moving sideways, but the international indicator squeezed out a modest gain.

This is how we closed 10/06/2025:

Domestic TTI: +7.54% above its M/A (prior close +7.57%)—Buy signal effective 5/20/25.

International TTI: +11.90% above its M/A (prior close +11.76%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli