ETF Tracker StatSheet

You can view the latest version here.

SHUTDOWN DRAGS ON BUT GOLD, SILVER, AND BITCOIN SHINE

- Moving the market

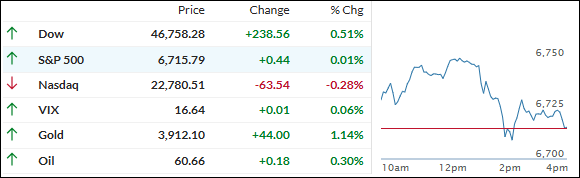

Wall Street started Friday strong, sending the S&P 500 to another all-time high, but that early rally lost steam by the close—even as stocks are on track for solid weekly gains despite the ongoing U.S. government shutdown.

With the shutdown now in its third day, traders are getting more anxious about all the usual worries: inflation, choppy economic policies, and a labor market that seems to be cooling off.

Because the shutdown has paused most government operations, important economic releases like the September jobs report didn’t show up this morning—a rare blackout that keeps the Federal Reserve somewhat in the dark ahead of its next rate decision.

On top of that, President Trump stirred things up with talk of large federal layoffs, calling the shutdown a chance to rethink government spending and agencies.

Big Tech cooled off today, with the S&P 500’s Mag 7 stocks trailing the rest of the index—and only the Dow managed to end the day in the green.

Meanwhile, bond yields and the dollar slipped, which helped gold notch a seventh straight weekly gain and another record close.

Bitcoin also had a standout week—its best since November of last year—though it stopped just short of new highs. Silver and copper both saw big jumps, giving some shine to commodities as the quarter kicks off.

So far this year, gold and silver have left the S&P 500 in the dust. Are the big gains in metals just getting started, or is a pause around the corner?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Stocks jumped out of the gate but lost steam as the day went on, with the S&P 500 and Nasdaq giving up their early gains.

Only the Dow kept its momentum and managed a solid finish at the close.

Our TTIs bucked the daily trend and wrapped up the week with gains, although only the domestic index moved higher for today’s session while the international one lagged.

This is how we closed 10/03/2025:

Domestic TTI: +7.57% above its M/A (prior close +7.46%)—Buy signal effective 5/20/25.

International TTI: +11.76% above its M/A (prior close +11.94%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli