- Moving the market

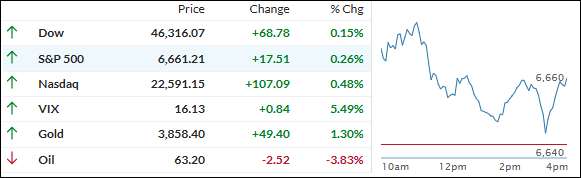

The S&P 500 and Nasdaq started strong today as Wall Street tried to bounce back from last week’s AI scare.

Nvidia led the charge, rallying just over 2% after its partnership with OpenAI sparked new debate about whether big infrastructure spending can keep the AI boom alive.

Advanced Micro Devices and Micron Technology both jumped too, giving the Nasdaq an extra boost thanks to ongoing big-ticket investments in the sector.

But while stocks managed modest gains, all eyes are glued to Washington as another government shutdown looms.

President Trump even warned mass federal layoffs could happen if Congress doesn’t hash out a deal before Tuesday’s midnight deadline—odds now stand at 77% for a shutdown.

Precious metals didn’t disappoint either.

Gold climbed 1.3% to fresh record highs, silver sliced through $47 to gain 1.5%, and copper raced ahead more than 3% on supply worries. Even bitcoin shook off its funk, with its ARKB ETF jumping nearly 5%.

So, here’s the big question: Can metals hold up if a government shutdown sets off bigger market ripples?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The Dow got off to a sluggish start today but made up lost ground and joined the S&P 500 and Nasdaq to post modest gains by the close.

The whole market wasn’t roaring, but a late-session boost helped all three major indexes end in positive territory.

Our TTIs finished mixed, with the domestic fund showing some solid momentum while the international side slipped a tad.

This is how we closed 09/29/2025:

Domestic TTI: +6.68% above its M/A (prior close +6.33%)—Buy signal effective 5/20/25.

International TTI: +10.86% above its M/A (prior close +10.91%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli