ETF Tracker StatSheet

You can view the latest version here.

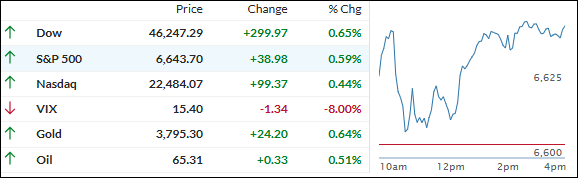

RATE CUT BETS INTACT AS GOLD AND SILVER SHINE, SHUTDOWN ODDS LOOM

- Moving the market

The Dow and S&P 500 got off to a solid start after August’s PCE inflation numbers landed right in line with expectations.

Core inflation ran at 2.9% over the past year—exactly what Wall Street had penciled in—and the broader index came in at 2.7%. Both figures suggest that the Fed’s path for two more rate cuts before year-end is still on track.

After a shaky week, stocks finally tipped higher, snapping a three-day losing streak as dip buyers jumped back in—especially in the Nasdaq, which perked up late in the day.

The jobs data and a stronger GDP reading yesterday put a small damper on bulls but didn’t shake the underlying optimism.

Bond yields held steady, gold smashed through $3,800 (though closed just below), silver cruised over $46, and bitcoin paced quietly.

With shutdown worries running hotter than ever—odds are over 80% now—everyone’s wondering if history will repeat, since past shutdowns have oddly fueled bullish rallies.

Is this calm just the eye of the storm, or will a government shutdown flip the script once again?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day started slow, with the Nasdaq taking its time before catching up with the Dow and S&P 500.

But by the close, the bulls managed to punch all the major indexes higher—even if it wasn’t quite enough to nudge the S&P 500 into positive territory for the week.

Our TTIs shook off the recent pullback and ended the week with only minor corrections, suggesting underlying strength is still intact.

This is how we closed 09/26/2025:

Domestic TTI: +6.33% above its M/A (prior close +5.05%)—Buy signal effective 5/20/25.

International TTI: +10.91% above its M/A (prior close +10.75%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli