- Moving the market

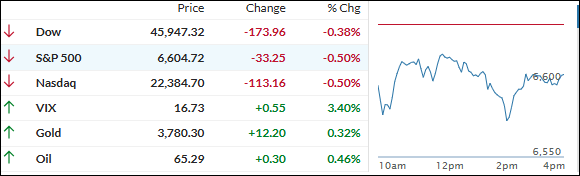

Stocks stumbled for a third day in a row as the latest pullback in Oracle and a fresh jump in rates weighed on sentiment.

Oracle slid another 4% and is now down more than 10% from its recent high, rattled by lingering doubts about the AI story and a new sell rating from Wall Street predicting a much deeper drop ahead.

That’s triggered fresh worries that investors are overestimating how much AI deals will really move the needle for Oracle’s cloud business.

Rising yields didn’t help, as the 10-year Treasury rate ticked up to 4.18% after stronger-than-expected jobless claims and a big upward revision to second-quarter GDP.

With economic data still coming in hot, traders are getting nervous that the Fed could pause on rate cuts—pulling the rug out from under the bulls just as the market was hoping for more easing.

Caution remains high with inflation numbers due tomorrow and new jitters about a potential government shutdown swirling.

Even multiple short squeeze attempts fizzled out, leaving the bears firmly in control by the close.

The only real pockets of green came from precious metals: gold edged higher, and silver crushed a 14-year high above $45. Meanwhile, bitcoin took a nosedive below $110k as Fed cut hopes faded.

So, is this just another September shakeout—or the start of a longer stay for the bears?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The bears grabbed the reins from the opening bell and didn’t let go, steering stocks lower all session and handing the major indexes another loss.

Our TTIs couldn’t escape the selling either and slipped from yesterday’s levels—though they’re still holding onto to their bullish stance.

This is how we closed 09/25/2025:

Domestic TTI: +5.05% above its M/A (prior close +5.92%)—Buy signal effective 5/20/25.

International TTI: +10.75% above its M/A (prior close +11.39%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli