- Moving the market

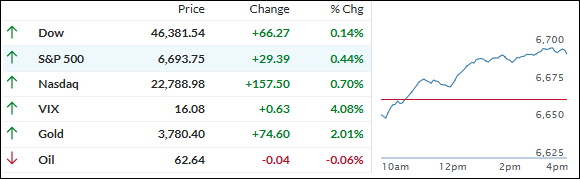

The week got off to a choppy start, with most major indexes opening in the red before regaining their footing.

The Nasdaq led the turnaround, clawing back above its unchanged line first and later dragging the Dow and S&P 500 along for the ride.

Despite the bounce, a looming government shutdown kept things from getting too lively—Congress still hasn’t sorted out a funding plan, and the deadline is less than a week away.

Still, stocks are coming off a strong run. Last week saw record closes for the major indexes, with the Russell 2000 small caps hitting a new high for the first time since 2021.

The Fed’s quarter-point rate cut is freshly baked in, and traders are now pricing in two more cuts by year-end and even more over 2026. But honestly, further gains will likely depend more on solid economic data than just rate moves from here.

Elsewhere, a short squeeze helped push equities higher today. Nvidia rallied 4% after announcing a strategic OpenAI tie-in, but precious metals stole the show—gold popped 2% to a fresh record above $3,780, and silver jumped over 2.5% to break the $44 mark.

Bond yields drifted a bit higher, while bitcoin dropped further, landing near $111k at a two-week low.

So far, the market’s shrugged off September’s reputation for volatility. The question is, can this momentum last through quarter’s end—or will some of these risks finally break through?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes shook off a soft open today and found their footing, gaining ground throughout the session.

Precious metals outshined the rest, with gold and silver posting solid advances for the day.

Our TTIs ended up with only minor changes, staying close to last week’s levels—so the big-picture bullish trend still looks intact.

This is how we closed 09/22/2025:

Domestic TTI: +6.04% above its M/A (prior close +6.41%)—Buy signal effective 5/20/25.

International TTI: +11.37% above its M/A (prior close +11.14%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli