ETF Tracker StatSheet

You can view the latest version here.

WALL STREET PAUSES AFTER RECORD RUN—IS THE RALLY LOSING STEAM?

- Moving the market

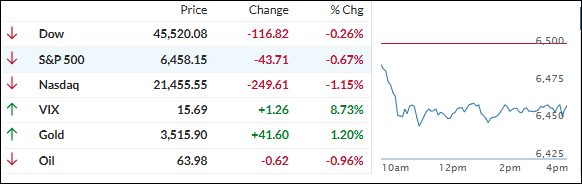

The way I see it, today’s market action was a classic case of “buy the rumor, sell the news.” After a week of record highs, Wall Street cooled off, with the major indexes slipping on this last trading day of August.

I believe this pullback reflects a mix of profit-taking and renewed caution around inflation and trade policy.

Surprisingly, despite NVIDIA’s blockbuster earnings—the stock fell over 3% today, weighed down by weaker data center guidance and news that Alibaba is developing its own AI chip. Among the Magnificent Seven, Tesla and Apple lagged, while Meta, Microsoft, and Amazon held up better.

I think the group’s dominance remains intact, with earnings growing 3x faster than the rest of the S&P 500.

On the macro front, the Fed’s independence is under scrutiny. President Trump’s attempt to fire Governor Lisa Cook has triggered legal battles and raised concerns about political interference.

It’s my view that this drama could complicate the Fed’s path forward, especially with rate cuts still expected in September.

Bond yields were steady, but lower for August, with the 10-year yield, barely budging as traders digested the latest PCE inflation data, which came in at 2.9% year-over-year. That’s the fastest pace since February, and I believe it’s keeping the Fed in a tough spot—cut too soon, and inflation could reignite.

The US dollar stayed about even, but dropped for the month, reflecting global currency shifts and uncertainty around Fed policy. I think traders are waiting for clarity before making bold moves.

Meanwhile, gold and silver rose, both gaining nicely as investors sought safety amid macro and political noise. These moves suggest a cautious bid for hedges, especially with September historically being volatile.

Bitcoin traded around $108k, yet lagged gold for the month, as the technical downtrend remains in place. Sentiment is neutral, and I believe crypto traders are watching macro signals closely before re-entering with conviction.

So, with markets digesting record highs, political drama, and inflation data, I have to ask:

Are we entering a healthy consolidation—or is this the start of a deeper correction as we are heading into the toughest month for US equities?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The final trading day of August didn’t go as hoped. The major indexes opened in the red and stayed there, wrapping up the month with a bit of a fizzle rather than a flourish.

Our TTIs were split. The domestic TTI held up relatively well, but the international TTI showed more pronounced weakness. I think this reflects growing concerns about global growth, especially in Europe and China, where economic data continues to disappoint.

This is how we closed 08/29/2025:

Domestic TTI: +6.56% above its M/A (prior close +6.69%)—Buy signal effective 5/20/25.

International TTI: +9.70% above its M/A (prior close +10.53%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli