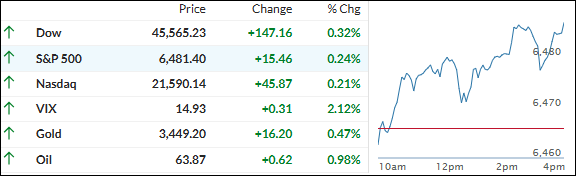

- Moving the market

Today’s stock market breathed a sigh of relief after a tough week, led by a solid rally sparked by Fed Chair Jerome Powell’s speech at Jackson Hole last week and Trump’s firing of Fed governor Cook.

It’s my opinion Powell’s message opened the door to a possible interest-rate cut in September, which really energized investors.

The way I see it, Powell’s acknowledgment of the fragile balance between inflation and a weakening labor market gave traders reason to hope the Fed might ease soon—but he was cautious, stressing the need to wait for incoming data first. That blend of optimism and caution set the tone for today’s gains.

Bond yields eased off a bit today, which helped soothe pressure on stocks—especially the rate-sensitive sectors. Meanwhile, technology and the Mag 7 stocks bounced back with a nice lift after a rough few days earlier this week, showing some renewed faith in growth names.

The dollar took a dive, adding further fuel to risk assets, while gold extended its gains, but is still stuck in its recent sideways groove. Interestingly, Bitcoin jumped, benefiting from the overall risk-on mood among investors.

This rally is a welcome break, but the way I see it, traders are still watching Powell and upcoming data closely.

The big question remains: Is this the start of a sustained rally fueled by rate cuts, or just a short-lived relief rally before volatility returns?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The major indexes kept climbing throughout the day and all managed to close higher, moving together in a pretty steady rally.

Today’s action felt pretty upbeat—especially for our TTIs, which also finished positive.

The domestic TTI stood out, showing more strength than the international one and giving the overall picture a bullish vibe.

This is how we closed 08/27/2025:

Domestic TTI: +6.74% above its M/A (prior close +6.36%)—Buy signal effective 5/20/25.

International TTI: +10.19% above its M/A (prior close +10.12%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli