- Moving the market

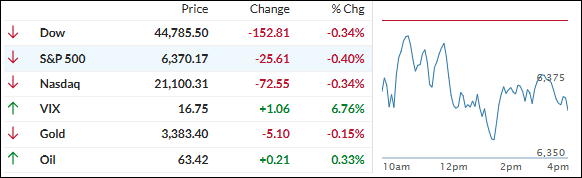

Stocks dropped together at the open, marking the fifth straight day of losses. Walmart slid about 4% after reporting its quarterly results—the company actually beat sales estimates, but its earnings came up short, leaving investors unimpressed.

All eyes are now on Federal Reserve Chair Jerome Powell, who’s set to speak Friday at the big Jackson Hole economic symposium. Traders are hoping to get some clues on where interest rates are headed next. In fact, the market’s pricing in nearly an 80% chance the Fed will cut rates at its September meeting.

Minutes from the Fed’s July meeting revealed officials are keeping a close watch on both the job market and inflation. Most policymakers, though, think it’s not quite time to start cutting rates yet.

Tech stocks have been dragging the market lower this week—investors have been selling off their winners like Nvidia, Palantir, and Meta, and the Nasdaq has dropped about 2.1% so far. But, surprisingly, the rest of the market has held up pretty well.

Meanwhile, bond yields pushed higher throughout the day, which didn’t do gold or Bitcoin any favors—gold’s just drifting sideways, and Bitcoin’s feeling the pressure too.

With Powell’s speech just around the corner, the big question is: Will the Fed shake things up and give the market a reason to rally, or are we in for more of the same?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Bullish vibes were nowhere to be found today, with the bears firmly in control yet again this week.

The only bright spot? Small caps managed to squeeze out a tiny gain and ended just slightly in the green.

Our TTIs took a hit along with the rest of the market, but the good news is they’re both still holding above their trend lines—which means we’re still in buy mode.

This is how we closed 08/21/2025:

Domestic TTI: +5.15% above its M/A (prior close +5.52%)—Buy signal effective 5/20/25.

International TTI: +9.77% above its M/A (prior close +10.17%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli