- Moving the market

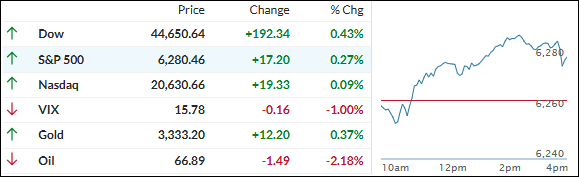

The stock market got off to a shaky start again, with early trading weighed down by ongoing tariff drama and a steady stream of tense trade talk—like Trump calling Brazil’s trade relationship “very unfair” and “far from reciprocal.”

That kind of rhetoric kept traders cautious and mostly on the sidelines.

Things picked up in the afternoon as bullish sentiment made a comeback, pushing the major indexes into the green. But a late-day pullback took some of the shine off, leaving gains looking pretty modest—despite another short squeeze.

Mega caps took a hit early on but managed to bounce back later. Bond yields ticked up slightly, oil prices dropped, and the dollar stayed flat.

The real headline-grabber? Bitcoin. It surged to a new all-time high, nearly hitting $114K intraday.

Gold also moved higher, though it couldn’t keep up with Bitcoin’s breakout. According to ZeroHedge, Bitcoin has now leapfrogged Google to become the 6th largest asset by market cap, while silver edged past Meta to grab the #8 spot.

Could this be the start of a bigger shift in the financial landscape?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

The day started off sluggish, but as bearish vibes faded, the bulls stepped in and nudged the market into the green.

That said, the rally lacked real conviction, so gains were on the lighter side.

On the bright side, our TTIs held steady, reinforcing our current positive outlook.

This is how we closed 07/10/2025:

Domestic TTI: +5.83% above its M/A (prior close +5.22%)—Buy signal effective 5/20/25.

International TTI: +9.69% above its M/A (prior close +9.42%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli