- Moving the market

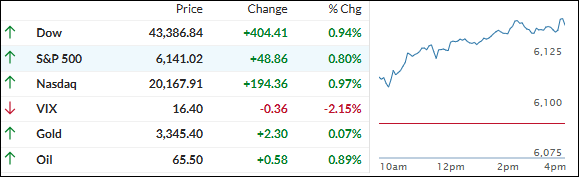

After a sluggish session yesterday, the markets finally found some upward momentum.

The S&P 500 is now eyeing its all-time high from earlier this year, having surged more than 20% since its April low. That rally has officially erased the losses for investors who held on through the bear market turbulence.

What’s fueling the optimism? Easing trade tensions are certainly helping, though not everyone’s convinced this rally has staying power.

Uncertainty still lingers around the impact of tariffs, the evolving situation in the Middle East, and the political wrangling over Trump’s “One Big Beautiful Bill Act,” which is facing mounting pressure.

On the bright side, today’s Initial Jobless Claims came in at 236,000—better than the 244,000 expected—suggesting the economy is still holding up, at least for now.

A short squeeze gave the indexes an extra boost, with mega-cap stocks hitting fresh highs. Falling bond yields added more fuel to the fire.

Meanwhile, the dollar slipped for the fourth straight day, hitting its lowest level since March 2022. That helped push commodity prices higher—Palladium led the charge, and our Copper position popped +2.8%.

Gold held steady, Silver gained 1%, and Bitcoin hovered around $108K after briefly testing that level.

All in all, it was a strong day across the board. But with so many moving parts, the big question is: Can this rally keep going, or are we due for a reality check?

2. Current domestic “Buy” Cycle (effective 5/20/2025); International “Buy” Cycle (effective 5/8/25)

Our domestic bullish cycle that began on November 21, 2023, concluded on April 3, 2025, following a market downturn triggered by President Trump’s tariff policy announcement.

This development caused significant declines across major indexes and broader market indices. However, markets subsequently rebounded, culminating in a new domestic “Buy” signal taking effect May 20, 2025.

Concurrently, our International Trend Tracking Index (TTI) experienced parallel volatility. On April 4, 2025, it breached critical thresholds, prompting a “Sell” recommendation. This position reversed as global markets recovered, with the International TTI regaining sufficient momentum to issue a new “Buy” signal effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

From the opening bell, it was clear the bulls were running the show.

The major indexes climbed steadily throughout the day, showing no signs of slowing down—even in the typically shaky afternoon hours.

Meanwhile, our TTIs were right in step, strengthening their positive outlook and confirming the market’s upward momentum.

This is how we closed 06/26/2025:

Domestic TTI: +2.32% above its M/A (prior close +1.55%)—Buy signal effective 5/20/25.

International TTI: +7.61% above its M/A (prior close +6.69%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli