- Moving the market

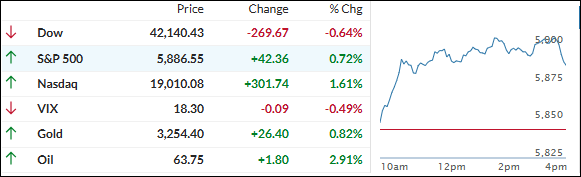

Early gains helped the S&P 500 and Nasdaq return to positive territory for the year, although both are still trailing gold’s performance by over 23%. Nvidia boosted the Nasdaq with a 7% rise in early trading, while the Dow remained in the red.

Sentiment remains positive following yesterday’s surge, with traders pleased that Trump secured more tariff concessions from China than expected. His chip deal in Saudi Arabia and reduced inflation fears further fueled bullish enthusiasm.

The CPI rose 2.3% annually in April, slightly below the 2.4% forecast. Core inflation held steady at 2.8%, matching consensus estimates. The inflation data surprise index hit its lowest level since August 2020.

The most shorted stocks continued their upward squeeze, marking their largest 40-day jump since December 2023. The MAG 7 basket has gained 7% since last Friday, and even retail stocks, impacted by the tariff war, have rebounded.

Bond yields continued to rise as rate-cut expectations declined. The dollar surrendered most of its gains, while Bitcoin, oil prices, and gold recovered.

Gold gained 0.82%, and silver rallied over 1%.

2. Current domestic “Sell” Cycle (effective 4/4/25); International “Buy” Cycle (effective 5/8/25)

Our domestic Buy cycle, which started on November 21, 2023, concluded on April 3, 2025. The market responded negatively to Trump’s tariff policy, leading to a sharp decline in major indexes and the broader market.

On April 4, 2025, our International Trend Tracking Indicator (TTI) also dropped significantly, triggering a “Sell” signal. However, it has since rebounded to a level that has generated a new “Buy” signal, effective May 8, 2025.

3. Trend Tracking Indexes (TTIs)

Yesterday’s rally persisted, but with less enthusiasm. The Dow closed in the red, while the S&P 500 and Nasdaq managed to finish in positive territory.

Similarly, our TTIs showed moderate gains.

This is how we closed 05/13/2025:

Domestic TTI: +1.37% above its M/A (prior close -1.15%)—Sell signal effective 4/4/25.

International TTI: +5.28% above its M/A (prior close +4.70%)—Buy signal effective 5/8/25.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly to get more details.

Contact Ulli