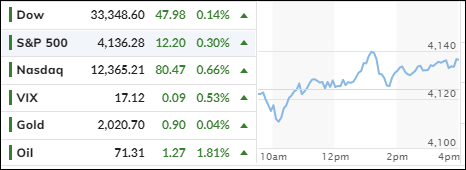

- Moving the markets

Last week’s moderate loss in the major indexes represented the S&P 500’s first two-week losing streak since February, with the overwhelming uncertainty being created by the ongoing debt ceiling negotiations.

We’re stuck in no man’s land waiting for decisions to be made, so markets can gain some traction and stop treading water. In the absence of any progress, it will be more difficult for the indexes to advance, in which case the path of least resistance will likely be to the downside.

The constant threat that looms over the markets, namely failure to reach a debt ceiling agreement, which could produce financial chaos, is promoted almost daily by Treasury Secretary Yellen with the deadline being June 1. Although she softened her rhetoric over the weekend by hinting that the US would avoid a default.

After an early drop, the major indexes rebounded to recapture their respective unchanged lines, thanks to a timely short squeeze, with all three of them eking out modest gains, while continuing to be stuck in a broad range. In the meantime, the economy, as represented by the Macro Surprise index, extended its 7-week slide.

In terms of what well-known mouthpieces uttered, ZeroHedge summed it up like this:

Biden said he will meet Congressional leaders tomorrow (Tuesday) to discuss the debt ceiling and that seemed to send stocks higher around 1300ET (even though there was nothing new in that comment at all).1325ET SEC’s Gensler said that there was no short-selling ban currently being weighed for US stocks (and rightly so because the last time they did that it triggered a massive wave of long liquidations).

1400ET Fed’s Bostic reconfirmed his ‘high for longer’ hawkish attitude by noting that he would probably vote to hold rates for now (but does not see cuts any time soon).

1410ET McCarthy warned that debt talks “nowhere near reaching a conclusion.”

Regional banks, as represented by their KRE index, rallied for no reason other than that we had a quiet weekend with none of them blowing up. The fact that Friday’s deposit data showed even more outflows, should have caused a bearish reaction. Go figure…

Bond yields rose moderately, as the 2-year successfully defended its 4% level. The US Dollar drifted lower, while Gold found some modest upward momentum.

The comparison to the S&P’s developments of 2010 are still on, but for how long is the question?

2. “Buy” Cycle Suggestions

For the current Buy cycle, which started on 12/1/2022, I suggested you reference my then current StatSheet for ETF selections. However, if you came on board later, you may want to look at the most recent version, which is published and posted every Thursday at 6:30 pm PST.

I also recommend you consider your risk tolerance when making your selections by dropping down more towards the middle of the M-Index rankings, should you tend to be more risk adverse. Likewise, a partial initial exposure to the markets, say 33% to start with, will reduce your risk in case of a sudden directional turnaround.

We are living in times of great uncertainty, with economic fundamentals steadily deteriorating, which will eventually affect earnings negatively and, by association, stock prices.

In my advisor’s practice, we are therefore looking for limited exposure in value, some growth and dividend ETFs. Of course, gold has been a core holding for a long time.

With all investments, I recommend the use of a trailing sell stop in the range of 8-12% to limit your downside risk.

3. Trend Tracking Indexes (TTIs)

With the markets rebounding, our TTIs followed suit with the Domestic one having crossed its trend line back to the upside again. Trading in a tight range is a sign of uncertainty in the markets.

This is how we closed 05/15/2023:

Domestic TTI: +0.32% above its M/A (prior close -0.24%)—Buy signal effective 12/1/2022.

International TTI: +5.61% above its M/A (prior close +4.96%)—Buy signal effective 12/1/2022.

All linked charts above are courtesy of Bloomberg via ZeroHedge.

Contact Ulli