- Moving the markets

Prophecies about which of the two Presidential contenders would give Wall Street more of what it needs to keep the bullish dream alive, namely continued reckless money creation, prompted ZH to post this succinct summary:

After reading months of ridiculously goalseeked Wall Street commentary, where first a Trump victory was the best outcome for stocks (at a time when Trump was seen as a favorite to win), then a Biden victory becoming the best-case outcome for risk assets (this predictably emerged around the time Biden took a lead in the polls), then a Blue Wave emerging as the most bullish outcome (around the time a Democratic sweep became the most likely outcome according to polls), and then following a brief detour when Wall Street briefly freaked out about Congressional gridlock when a split Congress suddenly became an all too real possibility, we went full circle and a Trump victory once again became the most bullish outcome (according to JPMorgan), traders and analysts would simply roll their eyes and snicker whenever a new “scenario” emerged from Wall Street’s strategy desks.

Yes, what it comes down to is this: Additional gloom and doom and catastrophes seem to guarantee the world only one thing, that is MORE STIMULUS! It’s pretty sad to realize that economies and fundamentals no longer matter with stock markets around the world being powered only by the generosity of those in charge of monetary policy.

Be that as it may, traders were relieved that the month of October did not turn out worse than what we saw, optimism prevailed, and the major indexes rallied into November. Lagging the bunch was the tech sector, which dipped into the red mid-day but managed to recover in the end.

The bullish theme was in part inspired by perceptions that maybe, just maybe, we were oversold last week, and that we might be electing someone tomorrow without much feared delays. Given recent reports, that indeed would be a tall order.

Gold performed well today, with GLD up almost 1%, and that in the face of a rallying US dollar, which as of late has taken the starch out of Gold’s upward momentum. I am not sure yet, if this is a harbinger of things to come.

Certainly, I expect market volatility to skyrocket, should the election outcome be postponed.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

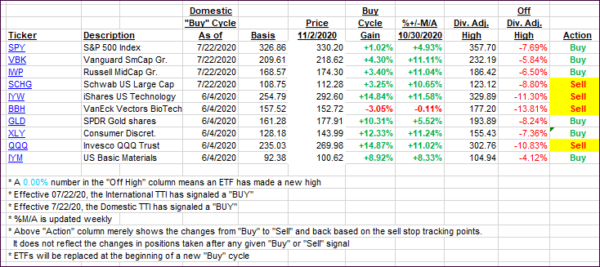

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this current domestic “Buy” cycle, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs recovered from last week’s bashing and sported nice gains.

This is how we closed 11/02/2020:

Domestic TTI: +7.58% above its M/A (prior close +5.23%)—Buy signal effective 07/22/2020

International TTI: +2.99% above its M/A (prior close +1.25%)—Buy signal effective 07/22/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli