- Moving the markets

An early market slump turned into a full-blown dump, as it appeared that the major indexes were struck by a dose of reality and, for a change, the headline scanning computer algos interpreted bad news as bad news. Even though we saw a last 30-minute pump, it only reduced the amount of damage done for the session.

Starting things on a bad note was the Fed’s Powell who said this during a webcast discussion:

“The scope and speed of this downturn are without modern precedent and significantly worse than any recession since World War II.

Additional government aid to household and businesses may be ‘worth it’ to keep lasting damage to the economy from developing.”

In the end, there was nothing new in his comments other than him contributing to the already sour mood in the markets, but more importantly, he confirmed and validated the fears many people had.

It’s now becoming more and more clear what I have said before, namely that you can’t just shut down a country’s economy, then flip a switch and expect everything to go back to normal in an instant. A recent poll confirmed that much, as almost 1/3 of the people interviewed responded that they would not go back to regular activities even if it were permitted to do so.

Throwing more gasoline on the fire was hedge fund guru David Tepper, who had this to say about the markets:

“While he suspects the bottom might already be in, there are simply too many areas in this market that are way too overvalued, and the legendary trader predicted more chaotic trading ahead. And speaking specifically about the Nasdaq, which has been on a surprising tear as just a handful of tech stocks carry the entire market, Tepper said the overvaluations were some of the worst he’s seen since 1999, the heyday of the dotcom bubble.”

Ouch! That was not what traders wanted to hear and down we went in a hurry. However, Tepper also suggested that “the Fed’s extraordinary backstop of financial markets could lead to further stock gains.”

So, there you have it. It looks to be a tug-of-war between a devasted economy on one side and the money pumping Fed on the other. Who will win?

There are many guesses and possibilities, but I believe that it’s wise, in terms of investment strategy, to let our Trend Tracking Indexes (TTIs) be our directional guide to issue a signal and let us know when a new entry point has arrived.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

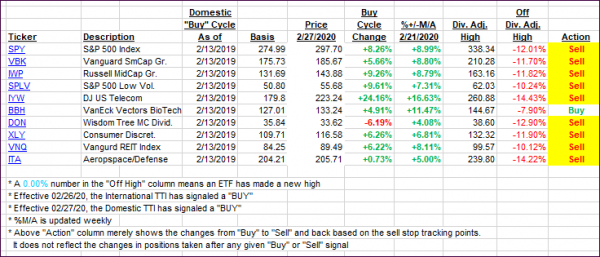

It features some of the 10 broadly diversified domestic and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which these ETFs are fluctuating above or below their respective individual trend lines (%+/-M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

For this past domestic “Buy” cycle, which ended on 2/27/2020, here’s how some our candidates have fared:

Click image to enlarge

Again, the %+/-M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

3. Trend Tracking Indexes (TTIs)

Our TTIs took a dive as equities got hammered.

This is how we closed 05/13/2020:

Domestic TTI: -14.33% below its M/A (prior close -11.74%)—Sell signal effective 02/27/2020

International TTI: -14.05% below its M/A (prior close -12.57%)—Sell signal effective 02/26/2020

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the specified guidelines.

Contact Ulli