- Moving the markets

The Fed did not cave to recent public pressure exerted by politicians and Wall Street traders but stayed the course and hiked rates ¼%, while also predicting another possible two increases next year down from the previously announced three.

While two is better than three, at least in the minds of traders, this was not as dovish an announcement as was expected, so the markets took the path of least resistance, which was “down.” In the process, not only were the early hopeful gains (the Dow traded in a 900-point range) wiped out “again,” but the S&P 500 also made new lows for the year while killing any remaining bullish sentiment for the time being.

The Transportation ETF (IYT) was the latest victim to plunge into bear market territory, as it gave back -3.11% to close -20.9% below its September record. Maybe that’s why a FedEx outlook suggested a severe global recession to be on the horizon.

Across markets, banks were clobbered to their lowest since November 2016 and high-yield bond prices got hammered the most in 8 months to the lowest since April 2016, according to ZH. This is the market’s worst year since 2008, worst quarter since Q4 2008 and worst December since 1931!

As Trend Trackers, we’re happy to watch this debacle from the sidelines. As a point of interest, since the effective date of our domestic Sell signal on 11/15/18, the S&P 500 has now lost -8.05%.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

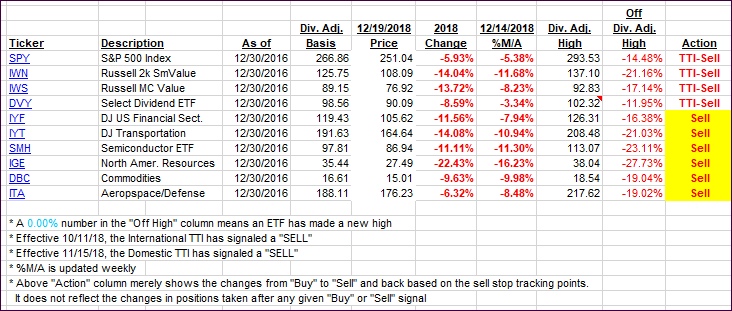

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating regarding their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our original candidates have fared:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long-term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -8% point has been taken out in the “Off High” column. For more volatile sector ETFs, the trigger point is -10%.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) dove as the markets collapsed—again. Right now, the bear is alive and well.

Here’s how we closed 12/19/2018:

Domestic TTI: -9.66% below its M/A (last close -8.21%)—Sell signal effective 11/15/2018

International TTI: -8.83% below its M/A (last close -8.24%)—Sell signal effective 10/11/2018

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling.

Contact Ulli