- Moving the markets

Right after the opening bell, there was no question as to which direction the markets would head as bulls were noticeably absent and weakness spread to most sectors. Anxiety was caused by a tech sell-off sparked by Facebook (FB), now also known as Faceplant, after the social media giant lost -6.77% and took the Nasdaq down.

Not only was FB’s drop its worst in some four years, it also did some chart damage by its price closing below its 200-day M/A for the first time since 1/5/17. The cause of all this were concerns about their management of user data, which can be loosely translated as “who all had access to their user data base?”

While these alleged misdeeds affected the entire market, it remains to be seen whether this will turn out to be just a company specific issue, and blow over quickly, or whether it will continue to cast a dark cloud over equities in general. Be that as it may, we should have that answer within a few days.

Not helping matters was continued nervousness and anxiety about the upcoming Fed meeting Tue/Wed under the new chair Jerome Powell. He is known to have a more hawkish view on rates and it is feared that he may favor four more hikes this year rather than the expected three.

Most likely, volatility will be with us until some of this uncertainty has been removed at which time we can put our focus back on the various trade war scenarios. Stay tuned.

- ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

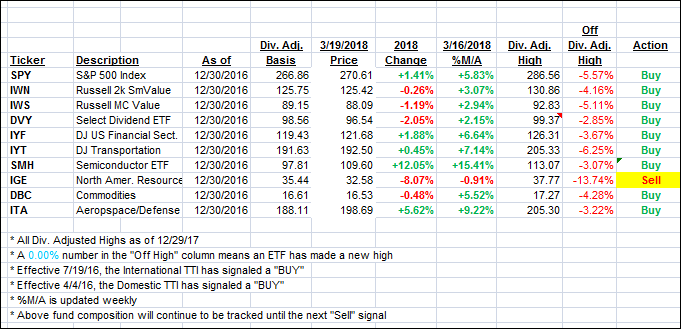

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how our candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) headed south as the bears were clearly in charge of today’s session.

Here’s how we closed 3/19/2018:

Domestic TTI: +2.71% above its M/A (last close +3.26%)—Buy signal effective 4/4/2016

International TTI: +2.52% above its M/A (last close +3.43%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli