ETF Tracker StatSheet

https://theetfbully.com/?p=18545&preview=true

Extending The Winning Streak

[Chart courtesy of MarketWatch.com]- Moving the Markets

Despite the major indexes hovering in negative territory for most of the day, in this new normal market environment, they are not allowed to close two days in a row in the red. As a result, as if by magic, stocks were pushed up during the last hour to be sure the Dow was able to extend its record-setting streak to a seventh session while the S&P 500 added +1.5% for the week.

The bears were on deck waiting for some downside follow through but, as we’ve seen numerous times over the past year, the late afternoon ramp destroyed any kind of hope for continued bearish sentiment. Again, the Trump euphoria remains in full swing fueled by promises of lower taxes along with massive infrastructure investments. Although it seems to me that enthusiasm has faded a bit over the past few trading days as White House sparring with MSM reached new lows.

Be that as it may, at this time, bullish momentum is in full swing, despite occasional hiccups, and Wall Street sentiment points to more upside for equities. However, it all seems very one-sided and surreal, so we need to be aware that not all is well economically, especially when looking at the potential for higher interest rates, which can derail this rally in a hurry.

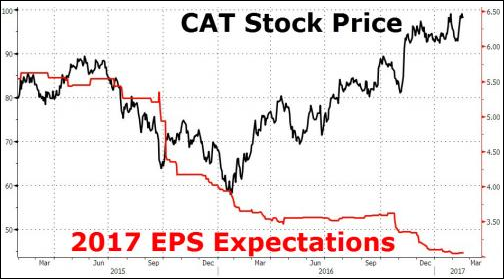

The fact that stock prices are rallying does not mean the underlying fundamentals warrant reckless up moves. Case in point is Caterpillar, a company that has not reported a single monthly uptick in sales for 50 consecutive months, yet its stock price has soared 18% since the Trump victory. Take a look at the chart:

Does this look like healthy and sound company to you whose stock you would want to own?

- ETFs in the Spotlight (updated for 2017)

In case you missed the announcement and description of this section, you can read it here again.

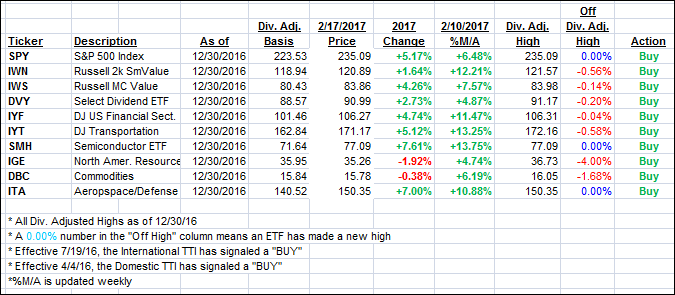

It features 10 broadly diversified and sector ETFs from my HighVolume list as posted every Saturday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

The below table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the 2017 candidates have fared so far:

Again, the %M/A column above shows the position of the various ETFs in relation to their respective long term trend lines, while the trailing sell stops are being tracked in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

- Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped a tad as the major indexes managed to barely crawl into positive territory.

Here’s how we closed 2/17/2017:

Domestic TTI: +2.81% (last close +2.83%)—Buy signal effective 4/4/2016

International TTI: +5.34% (last close +5.78%)—Buy signal effective 7/19/2016

Disclosure: I am obliged to inform you that I, as well as my advisory clients, own some of the ETFs listed in the above table. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli