In various past posts, I have mentioned that it is my belief that, economically speaking, we’re heading down a similar path as Japan did over the past 20 years.

Nothing was learned from their burst real estate bubble, and the same policy mistakes (bailing out failed banks, senseless stimulus packages, etc) have been made and are continuously being implemented.

I hope I am wrong, but if I am not, how will an investor deal with a similar scenario and be able to grow his portfolio?

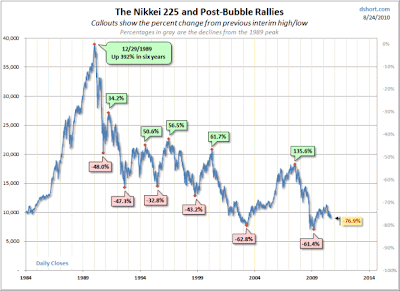

Business Insider featured an excellent chart by Doug Short with the title “Check Out All Of The Huge Rallies Japan Has Seen on Its way Down The Tubes:” A picture is worth a thousand words, and this one is no different. Notice the stunning market drops of the Nikkei 225 and the subsequent mind boggling recoveries. In the end, after 20 years of zigzagging, you would have ended up on the losing side of the ledger had you simply bought and hold your investments. This time period shows 6 bear market drops sufficient in size to wipe out all bullish periods and then some. The only way to survive this type of environment is to avoid the bulk of the down market whenever possible. Trend Tracking along with the disciplined use of sell stops will certainly be a better choice to accomplish that goal than mindless buying and holding. We already have gotten a similar taste of the above as the past decade in the U.S. was a lost one with the S&P; 500 having ended up to the downside. I am not being negative here, but I’m merely trying to point out that bear markets will continue to be with us from time to time, and that they have the awesome power to wipe out your previous investment efforts. No one can tell what the future will hold, or whether a Japan type scenario will play out here in the U.S., but it is wise to be prepared for these types of very real possibilities as opposed to simply having no plan of action at all.

[Double click to enlarge]