1. Moving the Markets

Markets rallied today as investors reacted to a rebound in oil prices of over 5%, but hesitancy remains amidst upcoming earnings season and the race for the White House.

The outlook for Q1 earnings remains bleak at present. Analysts expect a nearly 8% contraction in earnings, which would mark a third straight quarter of negative growth. That (by textbook definition) is called a ‘profits recession’. So, investors will want to hear some positive talk from CEOs about the future to get excited again about stocks.

Let’s remember, stocks aren’t cheap these days after the recent rally, Data that came in today said that stocks on average are trading at 17x earnings estimates and that refers to non-GAAP estimates, which are much less accurate and favor the companies. GAAP refers to Generally Accepted Accounting Principles and if those were actually applied, stocks on average would be trading in excess of 20x earnings.

Adding to the market confusion is that fact that the Fed said they may only hike interest rates twice this year, instead of four times. So, uncertainty remains in this sphere. Again, we are talking about a lousy ¼ of a percent hike here (or 1% per year), which apparently the economy is not able to handle without market turmoil. That alone tells you all about the state of the alleged recovery you need to know.

Lastly, political risk is still impacting markets. The race for the White House is still very much up for grabs and many of the candidates are “outside the financial mainstream”, which worries many investors. Thus, the markets are a bit stagnant until some of these worries gain more clarity.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

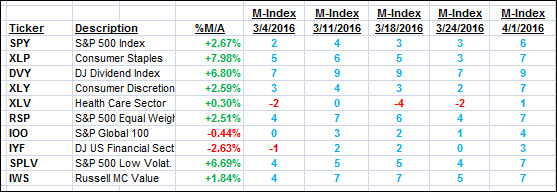

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

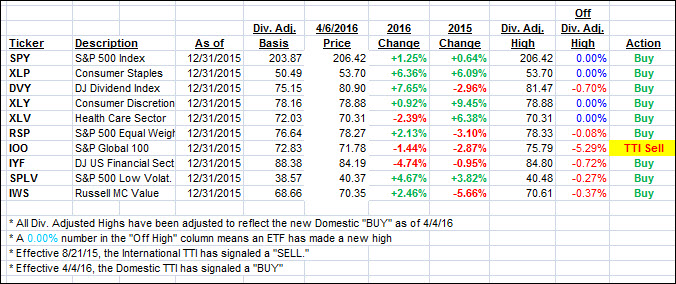

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) did an about face and rallied as oil spiked sharply and pulled the major indexes back up.

Here’s how we closed:

Domestic TTI: +1.49% (last close +1.02%)—Buy signal effective 4/4/2016

International TTI: -2.83% (last close -3.69%)—Sell signal effective 8/21/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli