ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

S&P 500 SLIPS AS GREECE WEIGHS ON MARKET

[Chart courtesy of MarketWatch.com]1. Moving the Markets

It was a nothing day as the major indexes meandered above and below their respective unchanged lines. In the end, the S&P 500 gave back a meager 0.43% for the week, which is minor if you compare it to the Chinese market, which dropped almost 7.4% today.

It was the same old story about Greece’s negotiations with its creditors; things are getting very slippery with a concrete agreement not being on the horizon. A line in the sand has been drawn by the Germans stating that a solution needs to be in place before the markets open on Monday.

Well, I won’t hold my breath but wish that Greece would finally do the unavoidable and default, since it’s inevitable anyway. Why prolong the agony? Nevertheless, there is another meeting of the euro finance ministers scheduled for Saturday to attempt to hammer out a last minute deal.

Domestically, consumer sentiment rose to its highest level in almost 6 months, which supported equities for a while but the ongoing Greek soap opera was too much of a negative.

9 of our 10 ETFs in the Spotlight managed to eke out again with the leader being the Dividend ETF (DVY), which added 0.59%. Closing slightly in the red was Healthcare (XLV) with a 0.14% loss.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

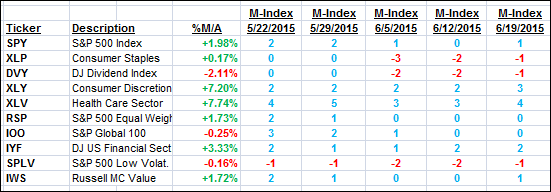

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

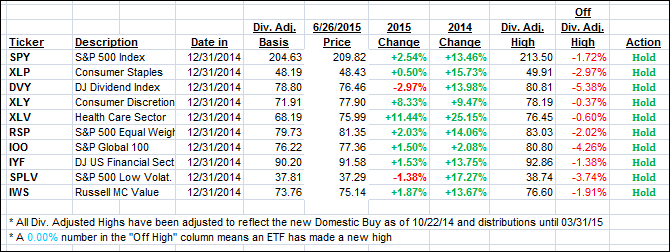

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) showed a mixed picture for the week with the Domestic one pulling back while the International one gained:

Domestic TTI: +1.61% (last Friday +2.13%)—Buy signal effective 10/22/2014

International TTI: +3.35% (last Friday +3.18%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli